Yearly, Folks say that lack of money and piling debt are a considerable concern.

When a person desires cash immediately, needs to stay away from chopping once more on their payments, and should’t ask their buddies or family, taking out a payday mortgage seems to be like your best option.

Granted, payday loans in Utah can protected fast cash with the principal primarily based totally on a portion of your paycheck. Nonetheless, there are evident disadvantages to creating use of for a payday mortgage.

Payday Mortgage Disadvantages:

Payday loans are expensive. Annual charges of curiosity can soar above 500%. Some payday mortgage lenders have unscrupulous methods much like hidden prices and rollover prices. Why would you ponder this type of mortgage if 22 states have authorized tips that limit payday loans or ban them fully? As you presumably can see, taking out a payday mortgage is just not always a sensible alternative. With that said, listed below are plenty of payday mortgage choices in Utah to acquire the money you need with out the massive expense.

1. Take a look at Native Nonprofits and Charities

Native nonprofit organizations and charities have a selected devotion to the communities they serve. A number of them will overtly lend money, meals, and sources to debtors, significantly all through an emergency.

Whereas lending from an space nonprofit group may appear to be an essential thought, it’s always intelligent to understand the larger picture in doing so.

Execs:

- You might receive free help to cowl fast payments

- While you need money for gasoline, groceries, or completely different urgent payments, borrowing from a charity is an effective alternative.

- You would not have to agonize about paying a mortgage once more.

- Borrowing from a charity doesn’t affect your credit score rating.

Velocity:

- There may be not a selected time for which you’ll have the ability to receive a mortgage from a nonprofit group. The time typically is set by the amount you need and which charities are positioned in your area. You’ll have to title the charity to hunt out out.

Cons:

- Many nonprofit organizations would require debtors to point proof of need, much like newest study stubs, monetary establishment statements, and funds, to lend.

- Charities aren’t financially sturdy. They’re usually restricted throughout the amount they’ll lend.

- Nonprofit organizations receive an enormous amount of lending requests every month. Which suggests there aren’t ample sources to distribute evenly.

2. Apply for an Installment Mortgage

An installment mortgage doesn’t sound acquainted to many people, nevertheless the frequent shopper has devoted to a minimum of one among them. It’s mainly a mortgage by way of which the borrower takes out a mortgage for a set amount of money at one time.

Mortgages, personal loans, and auto loans are frequent examples of installment loans, the place the borrower determines how lots they need and the way in which lots they need to pay in frequent installments.

Installment loans are great payday mortgage choices in Utah, nevertheless there are some noticeable disadvantages.

Execs:

- Installment loans are predictable funds. You might usually set the amount you presumably pays and make these adjustments to your funds, so that you just’re in no way caught off guard.

- Installment loans current the peace of ideas of realizing that your mortgage shall be completely paid by a specified date.

- Getting an installment mortgage in Utah may make it easier to repay debt faster with a modest fee of curiosity.

- Installment loans have extreme portions. You might receive as a lot as $2,000.

Velocity:

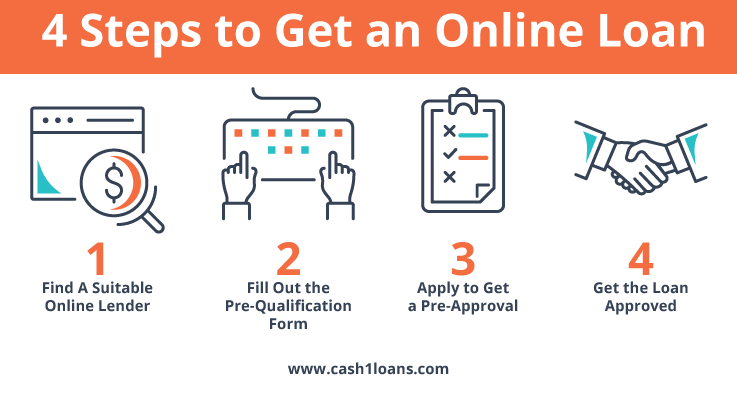

- After ending the pre-approval course of, you presumably can receive an arrange mortgage inside plenty of days, if not immediately.

Cons:

- Arrange loans aren’t like several types of revolving credit score rating (line of credit score rating, financial institution playing cards, and so forth.); you presumably can’t add to the mortgage amount. You’ll ought to perceive how lots you plan to borrow sooner than taking out the mortgage.

- The speed of curiosity and completely different phrases of your mortgage are largely dependent in your credit score rating. While you’ve struggled with any credit score rating factors to date, then there’s a sturdy probability that you’ll have to pay a high-interest worth.

- You can be pressured to pay completely different prices, which can enhance your entire month-to-month funds. That is decided by the lender.

3. Negotiate a Value Plan

When all else fails, it makes primarily essentially the most sense to strike up a handle your creditor and put together a price plan. Doing this may increasingly create an opportunity with the intention to pay once more your debt at a price and time useful for you.

Moreover, there’s a possibility you may have the ability to consolidate your debt, restore your credit score rating, and switch forward collectively along with your life. Proper right here is each factor you presumably can rely on whereas negotiating a price plan.

Execs:

- Many collectors are understanding. To them, it’s nothing personal. They’ll usually work with you beneath equitable phrases to make it possible for an affiliation could also be labored out.

- Talking to your creditor just a few value plan will give them confidence in inserting out a deal, significantly since you aren’t ignoring their cellphone calls.

- There’s a probability you presumably can consolidate your current debt.

Velocity:

- Your value plan could also be prepare instantly correct after your cellphone title with the creditor.

Cons:

- Counting on the creditor, the phrases of the price plan could also be one-sided in favor of them.

- While you aren’t reliable to the price plan’s phrases, the creditor may lose persistence and ship your case to a collections firm.

- Negotiating a price plan may harm your credit score rating if it isn’t fulfilled in response to its distinctive phrases.

4. Line of Credit score rating

A line of credit score rating in Utah is probably going one of many hottest emergency funds utilized within the US. A monetary establishment or financial institution will scenario a credit score rating line to a purchaser that they’ll draw from in a hard state of affairs.

Whereas using a line of credit score rating as an alternative to a payday mortgage is appropriate, proper right here is each factor it’s best to find out about this decision.

Execs:

- You might borrow solely the money you need all through an emergency.

- There are versatile reimbursement selections obtainable.

- Taking out a line of credit score rating is correct for sudden cash shortfalls.

- You might take out 100% of your credit score rating limit with none penalties or restrictions.

- There could also be always a lower frequent APR than using a financial institution card.

- Curiosity is barely charged on the borrowed amount.

Velocity:

- The approval time for a line of credit score rating software program can fluctuate. It could nicely take anyplace from two to six weeks to acquire a response concerning your software program.

Cons:

- There’s a extreme temptation to overuse this fund due to the convenience of entry.

- Having a continuing extreme stability can negatively affect your credit score rating score.

- This isn’t a wonderful decision for regular cash shortfalls.

- Charges of curiosity can fluctuate counting on numerous numerous components.

- There are month-to-month or annual maintenance prices to contemplate.

- Taking out a line of credit score rating is just not absolute best for debt consolidation since there’s a higher curiosity involved as compared with taking out a fixed-rate mortgage.

5. Try Completely different Strategies to Make Money

Discovering alternate options to earn a residing in Utah all through decided situations might presumably be your solely choice when it comes proper right down to it. As of late, side hustles are terribly frequent, making it the entire further useful for folk to retailer up reserve funds for emergencies.

Listed beneath are the professionals and cons of trying completely different strategies to earn a residing, along with how prolonged it could typically take to make any progress.

Execs:

- You possibly can start incomes income immediately.

- There are fairly just a few alternate options to make supplemental earnings, much like selling your clothes, signing up for a ridesharing agency, and turning your curiosity proper right into a enterprise.

- Making more cash is completely straightforward – you’ll be able to do it from the comfort of your private home with out many obtainable sources.

Velocity:

- The time period it takes to assemble an emergency reserve is set by your side hustle. Selling on-line devices can take plenty of weeks or months to make a income, while you possibly can earn every week by turning into an Uber driver.

Cons:

- The amount of money you presumably can earn from a side hustle might be not ample that may make it easier to navigate an urgent financial catastrophe.

- You can not have the time obtainable to reap the advantages of alternate options to make extra cash.

- You might shortly overwhelm your self in case you sort out too many duties.

6. Peer-to-Peer Lending

While you’re looking for to protected emergency cash with a low or no fee of curiosity, then peer-to-peer lending is one factor it’s best to ponder. This choice contains organising an settlement with a bunch or particular person you perception. While you need money, you presumably can put together in your peer to contribute to a fund, whether or not or not you desire a vehicle restore or help collectively along with your medical funds. Peer-to-peer lending has its perks, nonetheless it helps in case you acknowledge the drawbacks as correctly.

Execs:

- It’s a lot easier borrowing from people you acknowledge and perception reasonably than relying on a monetary establishment.

- There typically is just not a pre-approval course of. You might borrow inside what’s low cost with out being turned down.

- Your peer may additionally be eager to transcend what you need when you’ve a deep reference to them.

Velocity:

- The time period it takes to acquire funds can fluctuate. Typically, you may should attend plenty of days and even weeks in your peer to contribute to meet your goal.

Cons:

- The amount of money you presumably can borrow is restricted since your peer is just not a monetary establishment with near-unlimited reserves of cash.

- You can presumably end up prepared too prolonged to acquire money. All of it’s decided by how shortly your peer can enhance money in your behalf.

7. Apply for a Harmful Credit score rating Mortgage

A poor credit score mortgage can appear to be a godsend to anyone that desires fast cash whereas having a poor credit score rating score. Truly, a poor credit score mortgage is synonymous with a non-public mortgage.

Candidates will borrow what they need after which make month-to-month funds until the mortgage is completely paid off. Proper right here is each factor it’s good to find out about this mortgage.

Execs:

- You might receive fast entry to the cash you need.

- While you make nicely timed funds, your credit score rating score will improve.

- You’ll have higher than ample time to repay your mortgage, significantly in case you didn’t borrow lots money.

Velocity:

- You might receive your money inside minutes of your software program being accepted.

Cons:

- Your charges of curiosity will predictably be higher than common.

- There are fairly just a few prices it’s good to concern about, much like origination and late value prices.

- The lender can mechanically withdrawal the owed amount out of your checking account.

- You need some collateral to make use of.

8. A Credit score rating Card Advance

A financial institution card advance is simply the act of withdrawing cash out of your financial institution card amount. By taking out an advance, you might be borrowing out of your financial institution card to acquire fast cash.

While you’re curious, listed below are the professionals and cons of making this decision.

Execs:

- The money you need could also be accessed immediately with out having it in your financial institution card account.

- It is vitally greatest when you’ve a gradual earnings and are experiencing a sudden financial hardship.

Velocity:

- You might receive an advance inside a few minutes of creating use of.

Cons:

- You’ll be paying exorbitant charges of curiosity and prices.

- The curiosity will start to build up the money you receive your money.

- Your credit score rating utilization ratio will enhance, having a harmful affect in your credit score rating score.

9. Variety a Lending Circle

Similar to peer-to-peer lending, forming a lending circle helps you to borrow from trusted buddies and members of the family. Proper right here is each factor it’s good to find out about getting started.

Execs:

- You might borrow additional cash than you’ll with just one peer.

- You would not have to endure a protracted pre-approval course of.

- There aren’t any credit score rating checks, and it’s further cozy borrowing from people you acknowledge.

Velocity:

- You can be pressured to attend a while to acquire the money you need as your pals contribute.

Cons:

- You can wait too prolonged in your pals to contribute to your set off.

- You moreover may need to attend your flip if one different peer is in dire need of cash.

10. Get Help With Medical Funds

Accidents are a part of life, making it further frequent for folk and financial institutions to cut you slack in paying off your medical funds. While you want help collectively along with your medical funds and don’t must rely upon on-line payday loans in Utah, that is what it’s best to know.

Execs:

- There are so many strategies you presumably can receive assist, whether or not or not you ask your doctor for a price affiliation or converse to a medical bill advocate about negotiating your bill.

- You might receive a medical financial institution card to help collectively along with your payments.

Velocity:

- The time period it takes to acquire help collectively along with your medical funds can fluctuate tremendously. You can presumably wait plenty of days to acquire a medical financial institution card or a few minutes to rearrange a price plan.

Cons:

- Making use of for a medical financial institution card requires a credit score rating study.

- You’ll have to pay prices and a high-interest worth regardless of the alternative you choose.

11. Borrow from a Buddy or Family Member

If you happen to have no idea the place to point out, you presumably can always borrow money from a pal or member of the household. Nonetheless, don’t be too hasty in borrowing from buddies and members of the family sooner than considering the implications.

Execs:

- It’s always cozy borrowing from people you perception.

- Your people or members of the family could provide you with fast entry to the funds you need.

- Counting on who you ask, you’ll not be hassled into paying the money once more immediately.

Velocity:

- The time it takes to borrow from a pal or member of the household can fluctuate.

Cons:

- It is a vital probability that the person you ask may not have the money you need.

- You’ll have to ask plenty of buddies and members of the family for money in case you’re going by way of a financial catastrophe.

- Some family members and buddies is not going to lend you money in case you commonly ask them.

12. An Advance from Your Employer

Getting a cash advance out of your employer can seem downright intimidating. While you’re considering this choice, proper right here is the information it’s good to make an educated decision.

Execs:

- While you’re a helpful employee, you may not ought to endure a preapproval course of.

- There typically usually are not any credit score rating checks.

Velocity:

- The time it takes to acquire an advance out of your employer can fluctuate, ranging from plenty of days to plenty of weeks, relying in your need.

Cons:

- This choice might be not obtainable for individuals who discover themselves new to a job.

- If you happen to would not have the right relationship collectively along with your employer, you presumably might be denied.

13. Use a Paycheck Advance App

There might be discovered paycheck advance apps that promise to ship fast cash prematurely out of your employment earnings. Are these apps official? Right here is each factor it’s good to know.

Execs:

- These apps are easy to utilize, and the money you need could also be made obtainable inside minutes.

- There are generally fewer requirements as compared with completely different mortgage varieties.

- These apps is not going to study your credit score rating.

Velocity:

- Relying in your state of affairs, you presumably can receive your money in only some minutes.

Cons:

- Receiving this type of mortgage could also be expensive.

- You might merely fall proper right into a debt cycle by taking out too many loans.

- You’ll in no way assemble credit score rating.

Stay away from Payday Loans in Utah Proper now!

In the long run, there are quite a few routes you presumably can take to acquire fast cash with out going by way of the implications of taking out payday loans in Utah. To check further about how we may assist, study our personal loans in Utah instantly and get accepted in minutes!