Saving cash generally is a problem even in one of the best of occasions. With the rising price of residing and stagnant wages, at this time’s unsure financial outlook does not make it any simpler. Regardless of the difficulties, saving cash remains to be potential and e book will help you find out how. There …

$8,000 in 90 Days: Pay Off Debt Rapidly with These Steps

Able to discover ways to repay bank card debt shortly? You then’ve possible been doing a little bit of studying and looking the web. (It’s most likely why you’ve landed right here!) Personally, I’ve learn a lot of debt payoff tales during the last seven years of running a blog about cash and private finance. …

The Finest Budgeting Books for These New to Budgeting

Getting a deal with in your price range could be a problem, significantly in the event you’re new to managing your funds. However a very good ebook can assist you get began and keep motivated in your journey. Particularly in the event you’re in search of a brand new approach to price range within the …

Extreme Net Worth Financial Planning: What Does It Look Like?

As a extreme net worth specific individual with a numerous portfolio of belongings, taking the complexity out of financial planning is crucial to maximizing and preserving your wealth. On this text, we’ll uncover the nuances of extreme net worth financial planning, its six principal benefits, and the three key steps your financial advisor must cowl …

Why Must You Have A Wealth Supervisor?

Right wealth administration might make or break plans in your financial future. However, managing your wealth doesn’t should be daunting or refined. Having a wealth supervisor in your nook that may assist you to make financial alternatives is the first straightforward step to attaining your targets. On this text, we’ll reply the widespread question, “Why …

What’s a Credit score rating Bureau, and How Does It Work?

A credit score rating bureau is an organization that aggregates info on specific particular person clients and sells that info to lenders. These bureaus allow potential lenders notion into the creditworthiness of a doable debtor. Credit score rating bureaus acquire data from a wide array of sources. Completely totally different financial institutions report info to …

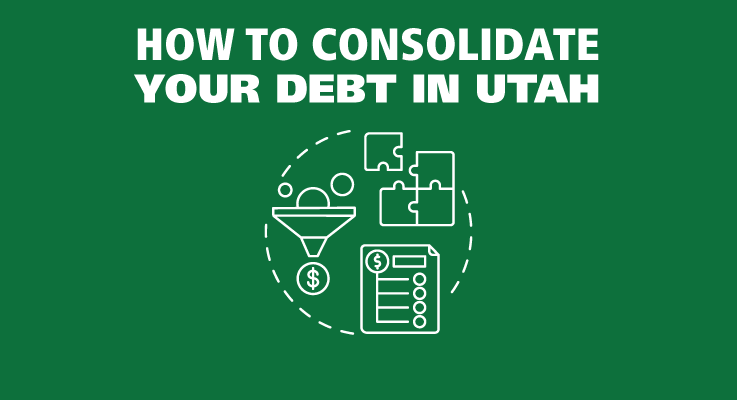

Consolidate Your Debt in Utah

Utah is for the time being the tenth state with in all probability probably the most household debt throughout the US. And with the pandemic nonetheless spherical, cash owed for the time being are rising. These household cash owed embody mortgages, auto loans, non-public loans, and plenty of others. Do you have to’re a sort …

Excessive 5 authorities education mortgage schemes to evaluate abroad!

Between 2016 and 2020, the number of Indian faculty college students studying abroad elevated by 20%! This has led to plenty of distinctive authorities education mortgage schemes that current financial help. The demand for education overseas has risen significantly, attracting a whole lot of hundreds of students on an annual basis. The primary causes for this …

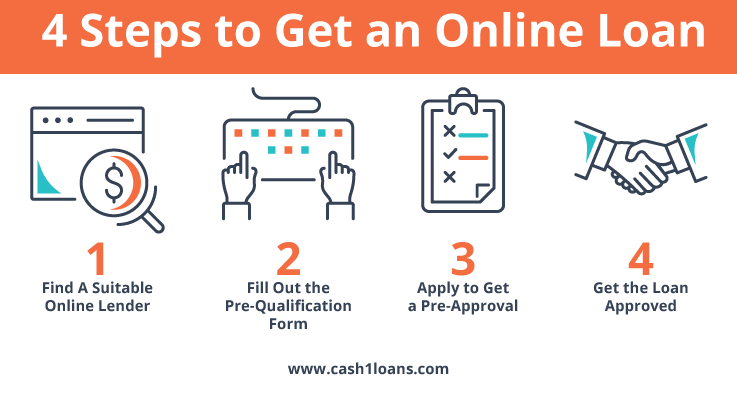

Pre-Approved vs. Pre-Licensed On-line Loans: Which means & Distinction

Did you get a letter saying you might be pre-qualified for a mortgage nonetheless have no idea whether or not or not which means you’ll get a mortgage or not? Is being pre-qualified the equivalent as being pre-approved? And which is finest: getting pre-qualified or pre-approved for an web mortgage? It’s commonplace to get such …

Finance Charges – All the Knowledge You Should Know

Whether or not or not taking out a mortgage or a line of credit score rating, it accompanies a justifiable share of financial obligations. Understanding these commitments is crucial should you want to make sound choices. One such obligation is the finance price. Finance charges are the worth of borrowing money. So, please be taught …