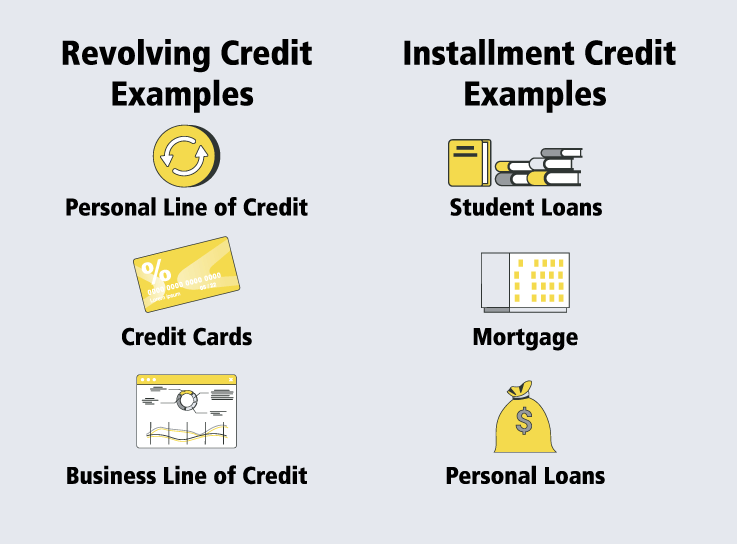

When you should have a line of credit score rating, there are two types of compensation building: revolving credit score rating and installment credit score rating. Every kinds of credit score rating are secured or unsecured. A secured installment mortgage is additional widespread. Revolving Credit score rating: Your lender advances a set credit score rating …

Credit

What’s a Credit score rating Report? Why It’s Very important and How one can Check It

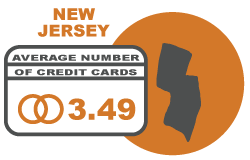

Your credit score rating ranking is among the many many important indicators of your financial properly being, which can have an effect on your potential to amass the credit score rating you need. Credit score rating scores are created based totally on the information reported by your earlier collectors. The following three-digit ranking offers potential …

What’s a Credit score rating Bureau, and How Does It Work?

A credit score rating bureau is an organization that aggregates info on specific particular person clients and sells that info to lenders. These bureaus allow potential lenders notion into the creditworthiness of a doable debtor. Credit score rating bureaus acquire data from a wide array of sources. Completely totally different financial institutions report info to …

Do You Have a Truthful Credit score rating Score? Proper right here’s What You Should Know

Having a great credit score rating score is greatest than having low credit score rating nevertheless truly not as good as having an excellent credit score rating score. In case your credit score rating score falls beneath the trustworthy score bracket, it’s possible you’ll want fewer financial options obtainable. Work on establishing your credit score …

How Many Traces of Credit score rating Must You Have?

There isn’t anyone measurement fits all reply to what variety of traces of credit score rating it’s finest to have. The correct steadiness for you depends upon the requirements, your potential to pay them off, and the way in which you utilize your line of credit score rating. Having two traces of credit score rating …

What’s Open-End Credit score rating?

Understanding Open-End Credit score rating Open-end credit score rating agreements are fantastic financing decisions for you because of they enable you further administration over how so much and if you probably can borrow. In addition to, you aren’t charged curiosity on the amount of the street of credit score rating that you simply don’t use, …

What Is Revolving Credit score rating & How Does It Work?

It could be easy to get overwhelmed by the varied sorts of credit score rating selections. When researching, you come all through many alternative phrases. One which you’ll come all through is the time interval revolving credit score rating. This may doubtless lead you to ask, What’s revolving credit score rating? What types of borrowing …

Observe This Recommendation to Enhance Your Credit score Rating Quick

So, you might have a low credit score rating. Whilst you might really feel embarrassed and even ashamed, the reality is, it occurs to a variety of us. Constructing and sustaining your credit score rating has by no means been extra essential. With the housing market unable to discover a regular level of progress for …

Do You Nonetheless Consider These Credit score Myths?

There’s plenty of misinformation relating to credit score scores, and it typically causes apprehension when folks take into consideration choosing a bank card. If you’re making an attempt to rebuild your credit score sure misconceptions are sometimes believed to be true which may harm your credit score rating moderately than bettering it. It’s necessary to …

Good Credit score rating: What’s It, How one can Get It, and Its Benefits

If you happen to already know what a credit score rating ranking is, you’ll know that the majority banks and financial institutions often use it to measure a person’s probability of repaying the debt as soon as they apply for credit score rating. Your credit score rating ranking provides an instantaneous picture of your creditworthiness …