You’ll qualify for a personal mortgage if in case you may have an excellent credit score rating ranking and a great earnings. Nonetheless, one different concern is getting your mortgage approved with low or unsteady earnings. Many lenders have a minimal earnings requirement protection, whereas others would possibly require you to sign your property as …

Loans

What Is a Mortgage Settlement? – Every little thing You Ought to Know

It’s widespread to click on the I comply with the phrases and situations field with out studying it, nevertheless it’s important to learn your mortgage paperwork fastidiously. Not like different service contracts or expertise privateness insurance policies, your mortgage settlement is full of necessities and particulars it is advisable to perceive. Whether or not a …

What Are On-line Loans with Month-to-month Funds?

Many lenders provide on-line loans with month-to-month funds. These lenders perform on-line and can even have bodily areas. There are pretty various on-line loans which have quick features and willpower processes. You would even get funds deposited in your checking account the an identical day you apply. Here’s what it’s greatest to find out about …

Learn how to Get a Line of Credit score with Dangerous Credit score

Do you know that sixty-eight million folks have bad credit report scores? Sadly, low credit score scores could make your life tough in a whole lot of methods. They will make it difficult to use for mortgages, bank cards, and different kinds of loans. It’s robust to make the most of a line of credit …

1099 Mortgage: How one can Get Personal Loans for Neutral Contractors & Gig Staff

Corporations won’t always uncover it economically viable to recruit new staff to fill the gaps. In that case, they might choose neutral contractors from exterior their group to execute specialised jobs or short-term duties. These workers have the freedom to work for various employers instantly and sort a part of the gig financial system. In …

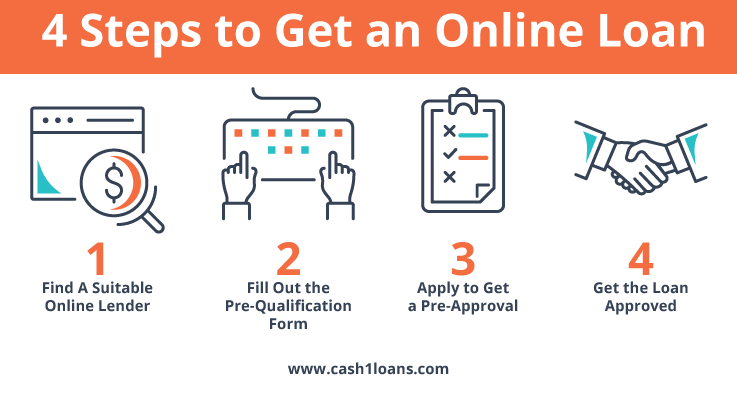

Making use of for a Mortgage On-line Vs. In Particular person – What’s the Biggest and Reliable Alternative?

Must I Apply for a Mortgage On-line or In Particular person? Deciding whether or not or not you have to try making use of for a mortgage on-line or particularly individual typically is a superior course of, significantly for individuals who discover themselves new to the financing course of. On-line lenders have a far more …

What Are the Completely completely different Types of Traces of Credit score rating?

Decrease than half (41%) of Individuals couldn’t cowl a $1,000 emergency with their monetary financial savings. That’s unsurprising as the value of dwelling continues to rise with out important changes in wages. In case you might be part of the majority which may not cowl an emergency of this measurement, a line of credit score …

Consolidate Your Debt in Utah

Utah is for the time being the tenth state with in all probability probably the most household debt throughout the US. And with the pandemic nonetheless spherical, cash owed for the time being are rising. These household cash owed embody mortgages, auto loans, non-public loans, and plenty of others. Do you have to’re a sort …

Pre-Approved vs. Pre-Licensed On-line Loans: Which means & Distinction

Did you get a letter saying you might be pre-qualified for a mortgage nonetheless have no idea whether or not or not which means you’ll get a mortgage or not? Is being pre-qualified the equivalent as being pre-approved? And which is finest: getting pre-qualified or pre-approved for an web mortgage? It’s commonplace to get such …

Finance Charges – All the Knowledge You Should Know

Whether or not or not taking out a mortgage or a line of credit score rating, it accompanies a justifiable share of financial obligations. Understanding these commitments is crucial should you want to make sound choices. One such obligation is the finance price. Finance charges are the worth of borrowing money. So, please be taught …