Getting money with an internet based mostly mortgage could possibly be easy and stress-free for individuals who work with the exact lender. You probably can apply on-line with out visiting a neighborhood division and use the loans for diverse capabilities, along with emergency payments, medical funds, lease, or relocation costs.

This article will cowl securing a mortgage on-line and discovering a superb lender.

What Makes an On-line Mortgage Easy?

An internet based mostly mortgage is an outstanding completely different to standard mortgage methods like credit score rating unions or banks. They supply various charges of curiosity and borrowing portions. Many on-line loans are unsecured, which means they don’t require collateral like a automobile or home.

On-line loans can embody a fast and easy software program course of, with approval selections in minutes. Funding might happen on the an identical day with a direct deposit or in-store cash pick-up.

Causes To Get On-line Loans

Listed beneath are some anticipated benefits that lenders provide:

- Lower credit score rating scores thought-about: Most on-line lenders wouldn’t have stringent credit score rating restrictions. They’ll even keep in mind higher than your credit score rating report when reviewing your software program. For instance, lenders might take a look at further elements, like your credit score rating historic previous or income.

- Simple software program course of: Many on-line lenders have a simple on-line software program course of. You’ll not should fill out prolonged, multiple-page capabilities or submit fairly a number of financial paperwork. You probably can full a number of of those capabilities in decrease than 5 minutes.

- Quick alternative: You could know whether or not or not or not you’ve gotten licensed to your mortgage in minutes, allowing you to finish the mortgage course of and get your funds sooner.

- Helpful: You probably can finish the lending course of out of your laptop. Whereas some on-line lenders might have retailer locations, you’ll not primarily wish to go to 1 for individuals who opt-in for direct deposit.

Sorts of On-line Loans

Installment Loans

On-line installment loans could possibly be unsecured or secured, paid once more in installments over a set interval. Lenders and debtors moreover examine with them as personal or consumer loans.

Title Loans

A title mortgage is a secured mortgage that makes use of your automobile title, harking back to a truck, automotive, RV, or bike, as collateral. Your mortgage limit is generally between 25% and 50% of the value of your automobile, as determined by the lender.

Payday Loans

Payday loans are short-term loans that typically ultimate until your subsequent paycheck arrives. You don’t want superb credit score rating to qualify for these loans on account of your credit score rating score simply isn’t a component.

Line of Credit score rating

A line of credit score rating is an affiliation between you and a lender. You’ve bought entry to money as a lot as a specific credit score rating limit. It permits a lot of withdrawals and repayments contained in the pre-approved borrowing limit.

How one can Choose the Most interesting On-line Loans

With so many on-line lending platforms, it’s going to probably take time to seek out out the easiest provider to your borrowing needs. The net mortgage web site ought to produce a mortgage that matches your financial needs most interesting. It’d seem obvious, nonetheless many people select the first on-line lender they uncover and take their potentialities. So, please do your evaluation and keep in mind these elements when evaluating on-line lenders:

- Mortgage portions: On-line personal mortgage portions can start as little as $100 and extend as a lot as $50,000 or further, counting on the lender. Keep in mind how loads it’s worthwhile to borrow and what it’s possible you’ll comfortably repay.

- APR fluctuate: APRs typically fluctuate from 6% to 35% or further, with the easiest fees accessible to primarily essentially the most licensed candidates. Uncover lenders that allow you to pre-qualify to see what charge you’ll in all probability have sooner than you apply and endure a troublesome credit score rating inquiry.

- Compensation phrases: Phrases are usually between 12 and 60 months. Nonetheless, some lenders provide further versatile or lengthier phrases than others. Don’t forget that longer compensation phrases finish in smaller month-to-month funds nonetheless might worth further over the scale of the mortgage. Maintain your value vary in ideas every time you choose a lender.

- Financing velocity: In case you need money fast, consider mortgage selections based mostly totally on each lender’s customary financing velocity. Whereas some provide same-day funding, disbursements on the following day are further frequent. In distinction, others might take a lot of enterprise days to course of. Don’t forget that your financial institution can also add further time to acquire the funds.

- Agency standing: Sooner than committing to any lender, study on-line evaluations and, if potential, communicate to family and mates who’ve already borrowed from that financial institution. On-line evaluations moreover provide notion into how prolonged the tactic might take, if buyer help is good, and whether or not or not debtors with widespread credit score rating qualify for aggressive fees.

Answering these questions will in all probability be vital indicators of on-line lenders to steer clear of and perception. Everytime you acquire a mortgage provide, on a regular basis evaluation the phrases sooner than agreeing to any mortgage.

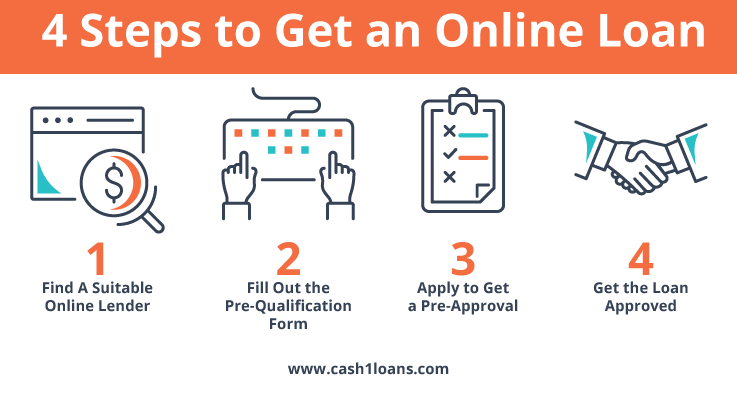

How one can Get On-line Loans With Quick Approval?

Whereas each lender has a specific software program course of, most have associated capabilities and underwriting processes. Adjust to these main steps to make use of for a easy personal mortgage on-line:

- Choose the easiest mortgage and lender. Look at the entire varied sorts of loans accessible on-line and choose the one which matches your financial needs. Then, choose a genuine lender that offers the mortgage of your choice.

- Accumulate compulsory paperwork. Sooner than filling out your mortgage software program, assure you’ve bought the entire required documentation. Most on-line lenders require you to have the following:

- Provide of income

- Social Security amount

- Authorities-issued ID

- Checking account

- Fill out an internet based mostly software program. Go to the lender’s website and begin the making use of and provide data like income and employment particulars, Social Security amount, and the amount it’s worthwhile to borrow. Primarily based totally on the lender you choose, likelihood is you’ll pre-qualify to see your charge, which usually doesn’t require a troublesome credit score rating take a look at.

- Analysis the gives. Some lenders ship a lot of mortgage gives based mostly totally on the data supplied as part of your pre-qualification. After pre-qualifying, select a proposal that works for you and full the making use of course of.

- Receive funds. If permitted, the lender will disburse your funds into your account. Relying in your lender, funds could also be accessible as rapidly because the an identical day. After that, it’s possible you’ll deal with your account on-line or with a mobile app.

Widespread Scams To Look For Sooner than Making use of

- Phone calls from people requesting money

Fraudsters will identify and declare you’ve bought been accredited for a mortgage nonetheless ought to pay money to get it. The caller might ask you to ship them a wire swap or a take a look at. Because of any credible lending web site shouldn’t be going to need you to pay sooner than receiving a mortgage, it’s fraud if any person telephones you and asks you to ship them money to build up a mortgage. Please don’t share personal data with the caller or give them any money.

- Calls from people claiming you owe money

Even for individuals who owe money, all genuine lenders are legally required to utilize appropriate debt assortment methods. They don’t appear to be allowed to harass or threaten you So, it’s most undoubtedly a rip-off for individuals who get an abusive or threatening phone identify from any person claiming to be affiliated with a lender you’ve bought used. On this case, it’s best to report the caller and not at all reveal personal data to them.

- Calls from people requesting checking account data

It’s a rip-off for individuals who get a reputation from any person claiming you’ve gotten been permitted for a mortgage and asking to your checking account login data. Respected lenders buy all of the data they require from you on-line and might not at all need entry to your on-line banking. So, protect your banking particulars from these callers.

Conclusion

On-line loans are comparatively new compared with standard banking. Nonetheless, the safety, velocity, and luxury of borrowing money on-line are gaining reputation. The flexibleness to make an knowledgeable alternative about the easiest on-line mortgage for you is essential. The above concepts will allow you choose a protected on-line lending agency, making you’re feeling assured getting loans on-line.