If you happen to already know what a credit score rating ranking is, you’ll know that the majority banks and financial institutions often use it to measure a person’s probability of repaying the debt as soon as they apply for credit score rating. Your credit score rating ranking provides an instantaneous picture of your creditworthiness to lenders. Although some people with poor credit score rating scores can nonetheless qualify for loans, the making use of course of won’t be as simple. If you find yourself in an similar state of affairs, there are strategies likelihood is you’ll apply to carry your credit score rating ranking.

Setting up a steady credit score rating historic previous doesn’t basically must take loads of time and effort. An excellent ranking will probably be an important challenge that makes borrowing money simple. Nonetheless sooner than leaping into one thing, let’s first understand what a wonderful credit score rating ranking means.

What’s a Good Credit score rating Score?

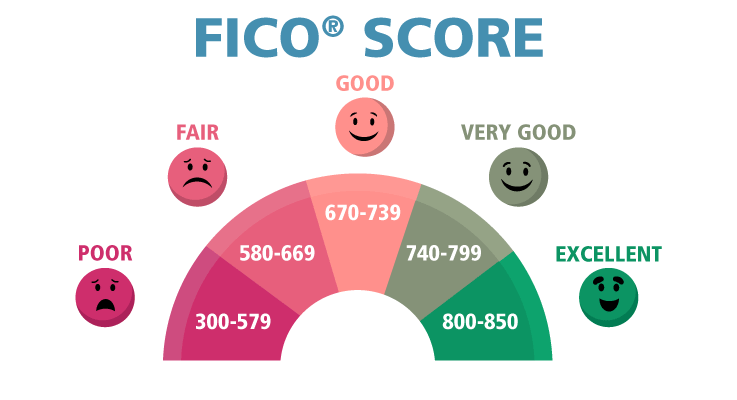

No ranking ensures greater mortgage phrases or expenses because of all people’s credit score rating state of affairs differs. With that said, it’s broadly accepted {{that a}} credit score rating ranking ranges from 300-850. Scores of 740 and higher are thought-about glorious. A credit score rating ranking of spherical 670 to 739 is usually considered good. Whereas these between 580 to 669 are thought-about inside the truthful class. A ranking under 580 is taken under consideration to be a a low credit score rating ranking . In case your intention is to carry your credit score rating ranking, understanding what influences your credit score rating scores and the best way your financial conduct would possibly help or hinder them is crucial.

What Parts Affect Your Credit score rating Scores?

Although utterly completely different credit-scoring fashions would possibly give numerous ranges of significance to each piece of knowledge in your credit score rating report, the widespread parts that impact any credit score rating ranking are inside the following 5 courses:

Charge historic previous:

One in every of many essential credit score rating scoring parts is your charge historic previous. Your credit score rating rankings can improve by making nicely timed funds in your accounts. However, failing to make funds, having an unpaid debt despatched to a gaggle firm, or declaring chapter would possibly lower your credit score rating ranking.

Credit score rating utilization:

The amount of credit score rating you might need in distinction with how lots credit score rating a lender has extended you’re easy to seek out out inside the case of installment loans like personal loans. Nonetheless, your credit score rating utilization ratio gives a share value of the complete glorious balances and your full credit score rating prohibit on all your revolving accounts, like financial institution playing cards and contours of credit score rating. A lower utilization cost is taken under consideration greater in your credit score rating scores.

Credit score rating Measurement:

You need some credit score rating historic previous to get a credit score rating ranking, making this an important challenge affecting your credit score rating ranking. It consists of the age of your oldest and newest accounts, the frequent age of all your credit score rating accounts, and whether or not or not you have got used a credit score rating account simply recently. It’s intelligent to consider the affect of the scale of credit score rating historic previous in your credit score rating scores sooner than opening or closing a credit score rating account.

Credit score rating Mix:

Your scores might improve in case you reveal you might responsibly deal with a number of kinds of credit score rating, like revolving credit score rating and installment credit score rating. You shouldn’t get a mortgage and pay curiosity solely in order so as to add it to your credit score rating mix because of it has little have an effect on in your credit score rating ranking. However, if all your borrowing has been by way of installment loans solely, it’s possible you’ll wish to apply for a financial institution card and use it to make small manageable funds each month.

Newest Credit score rating:

Everytime you apply for a model new line of credit score rating, collectors can look at your credit score rating evaluations. This could result in a credit score rating inquiry, which could appear in your credit score rating evaluations for as a lot as two years. Your credit score rating scores are unaffected by comfy queries, equal to individuals who consequence from checking your scores and some prequalification for loans or financial institution playing cards. However, arduous inquiries, which occur when a creditor examines your credit score rating sooner than making a lending selection, can shift your ranking from a wonderful credit score rating ranking differ to a poor or truthful one.

What to Anticipate with Your Credit score rating Score Differ

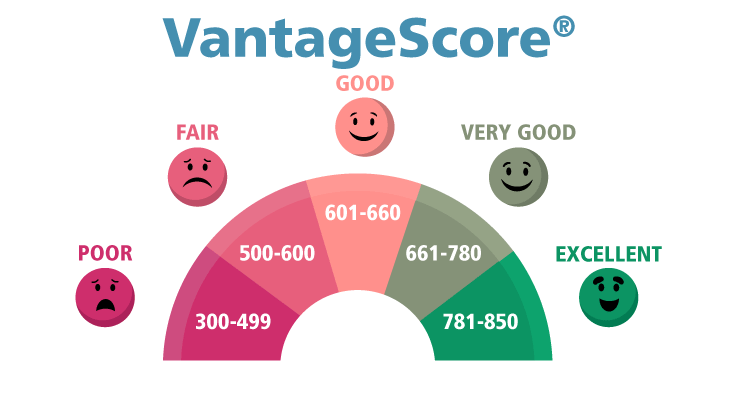

There are fairly a number of credit-scoring fashions, each producing credit score rating scores based mostly totally on the knowledge in your credit score rating report using a novel system. FICO® (Trustworthy Isaac Firm) and VantageScore® are the two most well-known credit-scoring corporations within the USA. With numerous variations, FICO® and VantageScore® at current differ from 300 to 850.

There are fundamental ranking ranges inside this scale that the majority collectors use to make lending decisions. You must use these ranges to know your current state of affairs and set financial targets. Listed below are a number of of the credit score rating ranking ranges:

Poor to truthful scores:

It’s possible you’ll want problem being accredited for fairly a number of financial institution playing cards or loans in case your ranking is poor to truthful. To determine or restore your credit score rating, it’s possible you’ll wish to begin out with a secured financial institution card or credit-builder mortgage.

Trustworthy to good scores:

You in all probability have a very good to good credit score rating ranking, it’s possible you’ll want further credit score rating decisions, nonetheless you received’t receive probably the greatest expenses or phrases. Although you would not have the perfect or the underside risk to lenders, there could also be nonetheless potential in an effort to elevate your credit score rating ranking and improve your financial state of affairs.

Wonderful or wonderful scores:

You in all probability have a wonderful or wonderful ranking, you often are inclined to get a mortgage with low-interest expenses and low-cost compensation phrases. Whereas collectors have in mind completely different factors when determining your eligibility, your credit score rating ranking will most certainly not be a barrier.

What’s a Good FICO® Score?

FICO® Scores are developed by the Trustworthy Isaac Firm, which claims that over 90% of the best lenders profit from solely FICO® Scores when making lending decisions. This credit score rating scoring model makes use of purchaser information from TransUnion, Equifax, and Experian, the three predominant credit score rating reporting companies.

As confirmed inside the above image, a wonderful FICO® ranking is between 670 and 739. Scores between 580 and 669 are considered truthful, whereas these between 740 and 799 are deemed “glorious.” A ranking of 800 or larger is claimed to be “wonderful.” And lastly, a “poor” ranking falls between 300 and 579.

What’s a Good VantageScore®?

Equifax, TransUnion, and Experian, the similar three credit score standing corporations FICO® makes use of to create its rankings, based mostly VantageScore® in 2006. They aimed to compete with the additional well-known FICO® scores. FICO® and VantageScore® have in mind making funds on time important for patrons to boost their credit score rating scores.

The ranges of the first two VantageScore® credit score rating scoring fashions had been 501 and 990. The 300 to 850 scoring differ is utilized by the two most recent VantageScore® credit score rating scores (VantageScore® 3.0 and 4.0). The current VantageScore® model classifies 661 to 780 as its good credit score rating ranking differ.

Why is It Very important to Have a Good Credit score rating Score?

Attaining your financial and personal targets can develop to be further simple with a wonderful credit score rating ranking. It’d significantly affect the amount it’s possible you’ll borrow and the curiosity or expenses you’ll need to pay on approval. Credit score rating rankings might have an effect on non-lending decisions, along with a landlord’s option to assist you to rent an home. Some employers would possibly look at your credit score rating information sooner than hiring or promoting. Furthermore, insurance coverage protection firms would possibly profit from credit-based insurance coverage protection scores in most states to find out your life, residence, and vehicle insurance coverage protection premiums.

How one can Get Good Credit score rating?

Establishing and sustaining a wonderful credit score rating historic previous shouldn’t be overly troublesome. Right here is a list of easy financial habits and behaviors it’s possible you’ll observe to assemble a wonderful ranking:

- Since your charge historic previous is taken under consideration to have in all probability crucial influence in your ranking, you need to always pay funds on time.

- In accordance with specialists, sustaining your credit score rating prohibit beneath 30% and even a lot much less is more healthy.

- It’s finest to stay away from making use of for numerous credit score rating features in short intervals, lowering your ranking.

- Confirm your credit score rating scores and evaluations month-to-month to stay away from incorrect or earlier information.

- Having an prolonged historic previous of managing financial institution playing cards and loans, significantly one full of funds made on time, will allow you assemble wonderful credit score rating.

How Prolonged Does It Take to Assemble Good Credit score rating?

First, you need to don’t forget that setting up good credit score rating won’t happen in a single day. Secondly, it considerably will rely upon the place you’re at inside the scoring differ and what financial difficulties you’re coping with. Within the occasion you’re a youthful grownup and have merely entered the world of credit score rating, it’s possible you’ll begin to assemble credit score rating by together with accounts to your credit score rating evaluations. You’ll not have a credit score rating ranking if in case you have got newly created credit score rating accounts in your credit score rating evaluations until you have got had them for a while. After at least one account has been open and on file for six months, you will have the flexibility to see a FICO® Score develop. However, a VantageScore® will create considerably further shortly. It’s possible you’ll get a VantageScore® in case your credit score rating ranking incorporates at least one account.

It’d take years for damaging information in your credit score rating evaluations, equal to missed or late funds or chapter, to fade and stop impacting your scores. Although will in all probability be years sooner than these damaging markings disappear, it’s possible you’ll nonetheless uncover an enormous enchancment. Be mindful, the precept thought is to continuously cope with enhancing your credit score rating and spot that the strategy takes time.

What’s the Benefit of Having a Good Credit score rating Score?

Improve your possibilities of mortgage and financial institution card approval

Get lower charges of curiosity and phrases from the lenders

Makes leasing an home or purchasing for a home less complicated

Decrease your bills in your auto and home proprietor’s insurance coverage protection

Get accredited for larger credit score rating limits

What’s a Good Credit score rating Score for Lenders?

Bigger scores create further lender confidence that you simply’ll repay your debt as agreed. Nonetheless lenders can set their definitions for what they have in mind good or a low credit score rating scores when evaluating you for financial institution playing cards and loans. Some lenders assemble their custom-made credit-scoring fashions, nonetheless the 2 commonest ones are these developed by FICO® and VantageScore®.

Conclusion

An excellent credit score rating ranking is the one that will allow you get what you need, whether or not or not it’s sooner entry to new loans, getting a model new job, or decreasing mortgage expenses. On the similar time, good credit score rating may also be subjective to the lender you choose.

It’s finest to make some extent to look at your credit score rating ranking sooner than making use of for a model new mortgage or financial institution card. Doing this could allow you understand your prospects of buying favorable phrases. In addition to, checking your credit score rating ranking earlier provides you the prospect to carry it and possibly stay away from paying an entire bunch and even a whole bunch of {{dollars}} in curiosity.

Monitoring your ranking can help you’re taking steps to carry it, rising your possibilities of being accredited for a mortgage, financial institution card, home lease, or insurance coverage protection protection whereas moreover strengthening your financial state of affairs.