There isn’t anyone measurement fits all reply to what variety of traces of credit score rating it’s finest to have. The correct steadiness for you depends upon the requirements, your potential to pay them off, and the way in which you utilize your line of credit score rating. Having two traces of credit score rating might probably be too many in the event you can not afford to make your funds or do not need plans to utilize it rapidly.

A model new line of credit score rating would possibly improve your credit score rating score. However, it’s finest to under no circumstances take out an extra line of credit score rating besides important. Making use of for a lot of traces of credit score rating in a short interval is not going to be prompt, and having too many traces of credit score rating make you look harmful to lenders.

How Many Traces of Credit score rating Do People Have?

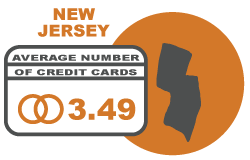

Whereas People, on frequent, have virtually 4 financial institution playing cards each, that’s solely a nationwide frequent. FICO discovered that cardholders throughout the great differ of credit score rating, scores 750 to 850, had three open accounts. That that they had a whole of six traces of credit score rating within the occasion you embrace closed accounts.

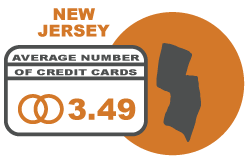

New Jersey residents have a imply 3.49 financial institution playing cards.

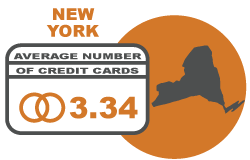

New York residents have a imply 3.34 financial institution playing cards.

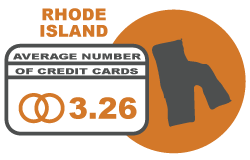

Rhode Island residents have a imply 3.26 financial institution playing cards.

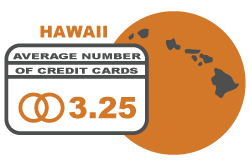

Hawaii residents have a imply 3.25 financial institution playing cards.

California residents have a imply 3.23 financial institution playing cards.

Do Traces of Credit score rating Affect Your Credit score rating Ranking?

What variety of traces of credit score rating you’ve gotten doesn’t straight affect your credit score rating score. Additional important than the number of credit score rating traces you’ve gotten is whether or not or not you pay on time and what variety of your obtainable credit score rating you utilize. Most people with great FICO scores, 795 or elevated, wouldn’t have late funds on their credit score rating tales. Moreover they solely use 7% of their credit score rating limit. Should you occur to’re contemplating of opening or closing a revolving line of credit score rating, maintain these in ideas:

Your Price Historic previous

How quite a bit credit score rating you utilize and your price historic previous resolve 65% of your FICO score. Paying your credit score rating traces on time is way further important than what variety of traces of credit score rating you’ve gotten. Should you want to assemble your credit score rating score fast – pay your credit score rating funds on time.

Your Credit score rating Utilization

How plenty of the credit score rating limit you utilize, referred to as the credit score rating utilization ratio, accounts for one-third of your credit score rating score. Retaining your ratio underneath 30% would possibly show you how to maximize your credit score rating score.

Should you occur to open a model new line of credit score rating and improve your whole credit score rating line, it could help assemble your credit score rating score by decreasing your credit score rating utilization. It’s critical to know that making use of for a model new line of credit score rating results in a tricky credit score rating inquiry which can rapidly drop your score a few components. You’ll want to avoid making use of for a lot of credit score rating traces; spacing functions six months apart will cease fairly just a few laborious inquiries from affecting your score.

Your Credit score rating Historic previous

The age of your line of credit score rating is essential. Lenders and collectors want to see regular and prolonged credit score rating histories. Nevertheless having one outdated line of credit score rating that was appropriately managed is not going to be ample.

Your credit score rating score is the frequent of the entire traces of credit score rating that you just’ve. A ding to your credit score rating is also worth it within the occasion you shut a line of credit score rating in the event you actually really feel the speed of curiosity is simply too extreme or the service is horrible. It’s always worth talking alongside together with your lender to see your decisions sooner than closing your credit score rating line.

Your New Credit score rating Accounts

Simply recently opened credit score rating accounts calculate 10% of your credit score rating score. The model new credit score rating could also be detrimental to you you in all probability have a short credit score rating historic previous. As talked about sooner than, it’s finest to attend a minimum of six months sooner than opening one different.

Your Credit score rating Mix

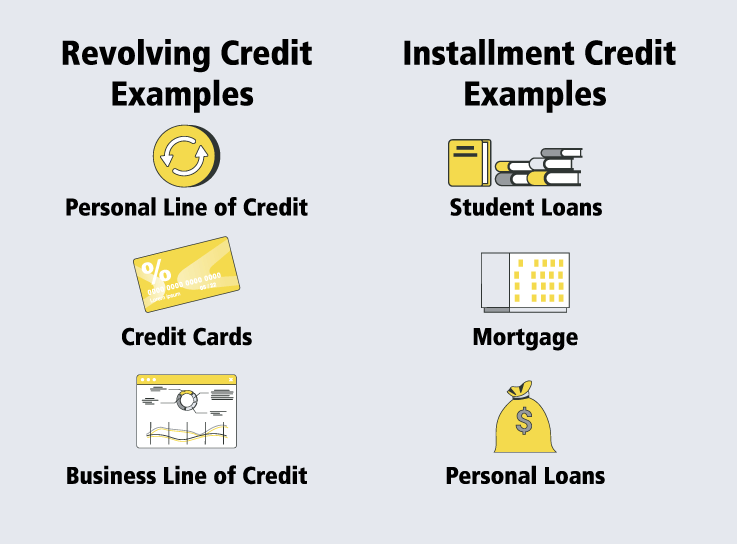

One different 10% of your FICO® score is your credit score rating mix or amount of credit score rating traces. The credit score rating bureaus ponder your variety of traces of credit score rating, retail accounts, and financial institution playing cards. It’s pointless to have each form of credit score rating, nevertheless lenders want to see you deal with a numerous differ of credit score rating traces.

Is It Good to Have Numerous Traces of Credit score rating?

Positive, you probably can have a lot of traces of credit score rating at one time. Most people have a lot of at a time. Should you occur to presently have financial institution playing cards, a mortgage, pupil loans, and so forth., you’ve gotten a number of line of credit score rating. There are execs to having a lot of as long as you keep up with all funds.

Professionals

Your FICO® score determines the amount and variety of loans you probably can deal with at once. That is no doubt some of the usually used credit score rating scores, and having a lot of traces of credit score rating can improve it. FICO sees the variety of loans as experience with borrowing money. You’ll not revenue from a lot of traces of credit score rating within the occasion you don’t maintain with funds, have a extreme credit score rating utilization cost, and use unhealthy credit score rating practices.

Cons

Although having a number of line of credit score rating could also be helpful, it comes with potential risks. Whenever you’ve gotten a lot of loans, you’re together with additional curiosity to your month-to-month payments. If in case you’ve extreme charges of curiosity, it could become troublesome to satisfy all price obligations on time.With a lot of traces of credit score rating to repay, it’s easier to miss to pay a bill. This would possibly negatively affect your credit score rating score and affect your chances of getting a long-term or short-term mortgage.Should you occur to take out too many traces of credit score rating, FICO could even see this as you being in financial trouble.

Deal with Numerous Traces of Credit score rating

Whilst you want to assemble your credit score rating, it’s best to have a minimum of two open traces of credit score rating. Protect your oldest credit score rating line open, and it’s finest to be succesful to get an enhance after making funds on time for six months. There are numerous strategies to deal with your credit score rating line, so listed under are eventualities for one, two, and three or further traces of credit score rating.

One Line of Credit score rating

One credit score rating account is widespread, significantly within the occasion you’re starting or establishing from any financial errors. If in case you’ve further established credit score rating, chances are high you’ll choose to have a single line of credit score rating to avoid any temptation of overspending or forgetting to make a price. The one problem with having only one credit score rating line is that you could possibly be be leaving monetary financial savings on the desk.

Two Traces of Credit score rating

Should you haven’t any debt alongside together with your two credit score rating traces, you probably can use a pair of reward taking part in playing cards. One could present cashback rewards, and the other could give you journey rewards or reductions at your favorite retailer. If in case you’ve debt or are making able to make a giant purchase that may take months to resolve, it’s finest to make use of a rewards card for frequently spending and a 0% card for financing.

Three or Additional Traces of Credit score rating

Having a third credit score rating line means which you could be further opportunistic with explicit presents and select and choose the easiest phrases. Should you occur to plan on paying in full, you probably can select in for the easiest rewards card to your most necessary month-to-month purchases. You need to make the most of two core taking part in playing cards and complement with the easiest preliminary presents obtainable. You possibly can moreover use just a few rewards taking part in playing cards with a 0% APR present. Nevertheless take note, the additional traces of credit score rating you’ve gotten, the additional you’ll should deal with these financial obligations.

Choose the Correct Number of Credit score rating Traces

Improve As Your Credit score rating Grows

An necessary concern determining what variety of traces of credit score rating it’s finest to have, or can have, is your experience. You’ll should ask your self you in all probability have established credit score rating or are you starting out? The a lot much less expert or, the extra critical your credit score rating score is, the much less decisions you should have and the additional you’ll should give consideration to 1 credit score rating line and deal with it responsibly.

Utterly Deal with Your One Card

If in case you’ve good or a bad credit report rating, you’ll should grasp a single line of credit score rating sooner than you develop to new horizons. It’d take a yr to pay larger than the minimal requirement on time and avoid racking the stability. Together with a model new line of credit score rating to the combo could doubtlessly improve your costs, hurt your current score and complicate points.

Automate Your Funds

One of many easiest methods to limit your chances of missing a price is by establishing computerized funds. It’s practically essential you in all probability have a lot of due dates to remember. You should have the selection to pay a personalized amount, pay the whole steadiness, or the minimal. You’ll should decide what works biggest to your funds, nevertheless within the occasion you’ve be taught this far, you notice the selection is to aim to pay in full. Paying off taking part in playing cards you don’t use usually is essential on account of small balances can quickly add up with charges on small purchases that you could possibly be overlook about.

Enhance Your Spending Prohibit

Should you want to improve your spending limit to decrease your credit score rating utilization, ponder asking your current card to increase your spending limit. You’ll be capable of avoid the possibility and hassles of constructing use of for a model new line of credit score rating.

Professionals & Cons of Opening A New Account

Professionals

- If you already have credit score rating, you probably can lower your whole credit score rating utilization ratio

- You’ll be capable of assemble your credit score rating faster on account of further data is reported to major credit score rating bureaus each month

- You’ll be capable of have entry to 0% financing or greater rewards You’ve got emergencies coated with further credit score rating

- You’ll be capable of reap the advantages of great sign-up perks

Cons

- You’ll be capable of improve your debt to unsustainable ranges

- You’ll be capable of hurt your credit score rating rapidly

- You’ll be capable of have concern managing a lot of due dates

Widespread Credit score rating Card Stability by State

Are you questioning how your state matches up with a line of credit score rating balances? That is who has the easiest credit score rating balances.

State Widespread Credit score rating Card Stability Alabama $5,672 Alaska $8,026 Arizona $6,053 Arkansas $5,327 California $6,222 Colorado $6,416 Connecticut $7,082 Delaware $6,335 District of Columbia $7,077 Florida $6,460 Georgia $6,569 Hawaii $6,673 Idaho $5,213 Illinois $6,253 Indiana $5,254 Iowa $4,774 Kansas $5,769 Kentucky $5,140 Louisiana $5,811 Maine $5,44 2 Maryland $6,946 Massachusetts $6,213 Michigan $5,399 Minnesota $5,489 Mississippi $5,134 Missouri $5,601 Montana $5,482 Nebraska $5,423 Nevada $6,220 New Hampshire $6,235 >New Jersey $7,084 New Mexico $5,851 New York $6,491 North Carolina $5,832 North Dakota $5,265 Ohio $5,560 Oklahoma $5,848 Oregon $5,498 Pennsylvania $5,840 Rhode Island $6,177 South Carolina $5,938 South Dakota $5,235 Tennessee $5,688 Texas $6,753 Utah $5,600 Vermont $5,466 Virginia $6,969 Washington $6,156 West Virginia $5,144 Wisconsin $4,961 Wyoming $5,782

Are You Looking for A Line of Credit score rating?

If in case you’ve been denied a line of credit score rating on account of you’ve gotten a bad credit report rating or no credit score rating the least bit, you probably can apply on-line.