Hold Calm

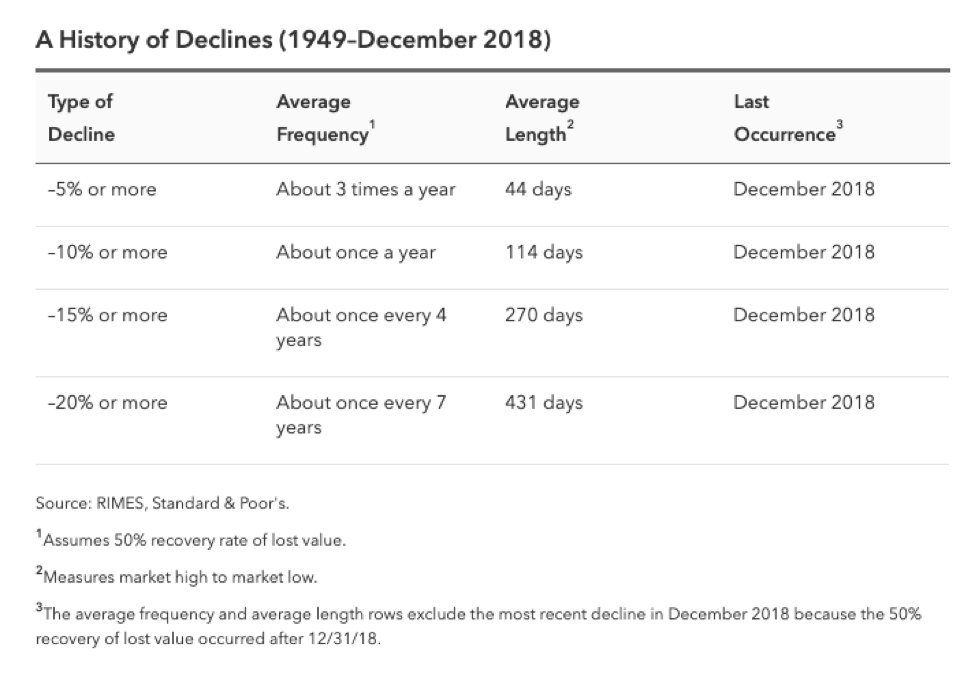

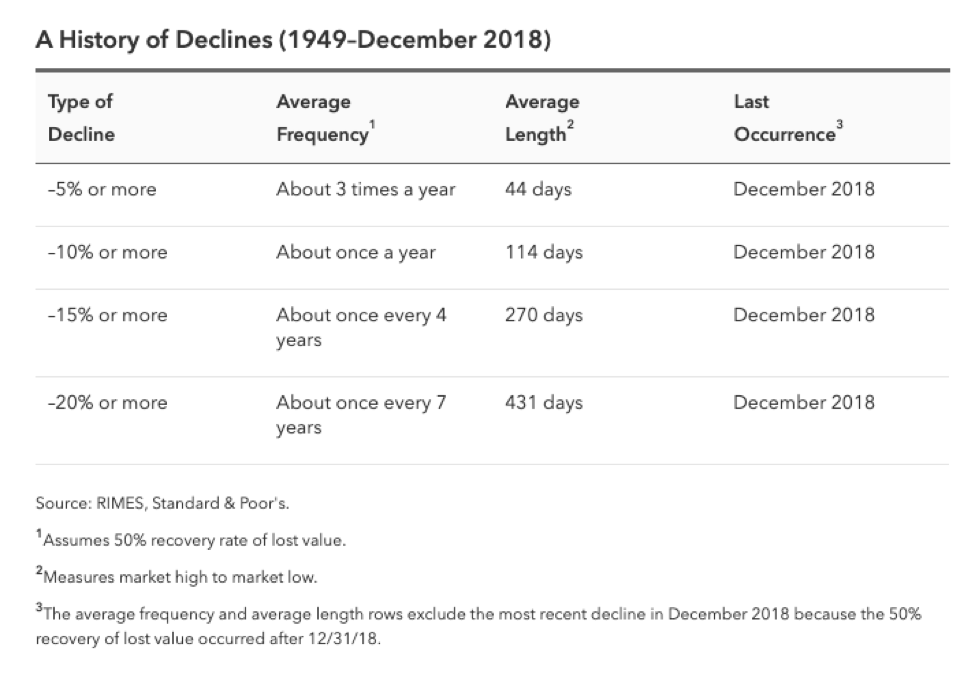

At cases like these, it’s mandatory to position current conditions into perspective. This isn’t the first time the market has taken a tumble from present highs and it acquired’t be the ultimate. Declines throughout the Dow Jones Industrial Frequent are fairly widespread events. In precise truth, drops of 10% or further happen about yearly on widespread. The stock market is a harmful place to take a position and ups and downs must be anticipated. If it weren’t harmful, it couldn’t ship bigger anticipated returns.

Understand How Markets React

We merely mustn’t have adequate information however to know how the coronavirus will have an effect on the financial system throughout the temporary and long term. It’s doable that the virus will rapidly be well-contained, and the markets will recuperate. Nevertheless it’s additionally doable that the virus will unfold and have an effect on world markets, which could end in a full correction or maybe a longer-term recession.

It’s essential to don’t forget that the market is pricing in information immediately and it’s nearly not potential to predict how merchants will react as further information is obtained. As we’ve now seen this week, info travels very fast and by the purpose you hear the knowledge and try to react, the markets can have already priced that information into the value of shares. In addition to, there are in all probability totally different events effecting stock prices, akin to an upcoming presidential election or one factor absolutely unknown. We merely don’t know.

Hold the Course

Whereas easier said than achieved, worthwhile long-term merchants know that it’s mandatory to stay calm all through cases of extreme volatility and fear. The media can usually make it seem like each world event is worse than the one sooner than, nevertheless that must not impact your plan. As quickly as one catastrophe is over there’ll in all probability be one different. In reality, volatility doesn’t hurt merchants, nevertheless selling when the market is down usually does. Markets are terribly atmosphere pleasant, and to allow them to recuperate merely as quickly as they refuse. So, do you have to advertise’s potential you’ll not solely lock in losses and miss a rebound, however moreover create taxes which is ready to further decrease the value of your investments.

Keep in mind That Your Portfolio is Based mostly totally on a Plan

We understand that volatility and market declines are disturbing. However, we encourage you to do not forget that whereas the stock market is also down significantly, your portfolio depends on a plan that’s designed that can assist you attain your targets. Your portfolio is properly diversified and made up of shares, bonds, and totally different belongings which is likely to be designed to work collectively to decrease complete losses. It’s essential to ponder your specific portfolio, funding horizon, and circumstances when reflecting on monetary events.

Evaluation Your Plan

In case you’re truly fearful in regards to the impression of the market and having trouble sleeping, now could be an environment friendly time to take a look at your complete funding accounts to you should definitely are nonetheless on monitor and your hazard tolerance is constant along with your expectations. There’s a chance that the swings out there out there have decreased your publicity to the market as a whole and also you’ll have to rebalance in order to grab the returns wanted to reach your targets.

Seek for Alternate options

In its place of wanting on the glass as half empty, flip it spherical and seek for the positives. Capitalize on options to acknowledge losses, which can save enormous on taxes, maximize your retirement contributions to make purchases whereas companies are on sale, and in the event you’re lucky adequate to have cash available or have merely obtained a bonus, use the funds to rebalance and buy low. Take note of altering IRA belongings to Roth IRA’s and seize the rebound in a tax-free account. These are just a few ideas it’s potential you’ll want to consider

Converse with Your Advisor

Whether or not or not you’re new to investing or an expert investor, it’s on a regular basis helpful to have any individual to talk with and an unbiased, fee-only fiduciary advisor is an effective place to start out out. Human nature causes us all to behave out of emotion when cases are highly effective and tensions extreme. That’s the time when an incredible advisor earns his or her protect. Attain out to us any time to judge your portfolio or just to vent. We’re proper right here that can assist you make educated choices that aren’t pushed solely by emotion.

Identify us or e mail us any time to talk or to rearrange a time to satisfy and consider your plan. That’s what we’re proper right here for and we welcome the prospect to answer your questions, cope with your concerns, and try to alleviate a couple of of your stress.

This too shall transfer!