Shopping for a house is an intense course of, particularly for first-timers. I ended up shopping for my first dwelling in July 2013. It was a loopy expertise, and since then I’ve gotten plenty of questions on the right way to purchase a home (and even wrote a e book as soon as upon a time on the very subject of millennial homeownership!), so I’ve compiled all of my data right here.

What follows is the 30,000-foot view of the eight most simplistic steps of the home-buying course of. My final purpose with this piece is to empower first-time consumers to ask questions and really feel assured concerning the buying choices they make. And now that I am a licensed, full-time agent, I’ve much more data to share. Right here’s extra about me as an agent. Let’s see if it’s a match and work collectively!

Learn how to Purchase a Home

- Step 1 – Assess your readiness

- Three inquiries to ask

- Step 2 – Calculate your affordability

- Learn how to calculate dwelling affordability

- Step 3 – Verify your credit score

- Step 4 – Save up for the down fee

- Learn how to save extra cash on your down fee

- Step 5 – Get pre-qualified

- Step 6 – Store for a house (And make a suggestion!)

- Discover an agent

- Construct your wishlist

- Do drive-bys

- Make a suggestion

- Step 7 – Due Diligence and Mortgage Underwriting

- Step 8 – Closing on your own home (here is how lengthy it takes to shut on a house, usually)

Learn how to purchase a home: Step 1 – Assess your readiness

Step one to purchasing a house is evaluating if you’re a) financially and b) emotionally prepared to purchase. Since it is a massive buy factoring in a whole lot of 1000’s of {dollars}, you need to ensure you’re totally ready for what the dedication to homeownership actually means. There are three questions I like to recommend dwelling consumers ask when assessing if now could be the appropriate time to purchase (And listed below are 16 extra inquiries to ask if/while you need to purchase a house)

Ask: Is it higher financially to hire or purchase?

Typically, shopping for a house is the extra fiscally sound choice since you’re constructing fairness in a house you may money in later. What many monetary specialists do not discuss is simply how a lot worth there may be in being a renter, together with:

- Flexibility – A 12-month lease is way simpler to get out of than a 30-year mortgage, and you may be picky about the place you need to dwell. Plus, you’re capable of transfer round everytime you need to or have to.

- Upkeep – If one thing breaks in the home or residence, all you need to do is name the owner. (That is nice when you’re not that useful!)

- Smaller emergency fund – As a renter, you may have a smaller emergency fund since you’re not liable for dwelling upkeep and maintenance and there are fewer up-front prices to hire.

Determining the right way to purchase a home is an enormous way of life change. Deciding whether it is financially advantageous to purchase will depend upon the place you reside so that you’ll need to run the numbers. Right here’s an excellent hire vs. shopping for calculator I like.

Ask: Do I actually know the place I need to calm down?

When you’ve learn the weblog a very long time, (assume over a decade) my story. I moved off to New York at 23. After two years within the metropolis, I wished to maneuver again dwelling to Georgia, and never only for the interim. Having had the expertise of dwelling distant from dwelling was an incredible factor as a result of it taught me what I did and didn’t need. I knew that shifting again south was (almost definitely) for the lengthy haul, so I felt comfy with the choice to place down some official “roots,” however for a lot of, the ’20s are a time of exploration.

Being unfettered by a mortgage means you may take that job in one other state or transfer overseas when you so need. No matter your monetary greatest life seems to be like, you may pursue it whole-heartedly, as a result of you haven’t any strings.

Making dwelling possession inexpensive and viable in your 20s actually solely works when you can decide to your own home for at the very least 5 years (both dwelling in it as your main residence or renting it out.)

You must take into account these items too when making an attempt to determine the place you need to put down roots:

- Metropolis, Suburban, or Rural – Do you need to dwell in a bustling metropolis, a suburb division, or a wide-open rural space? There are professionals and cons to every, and every one will have an effect on your mortgage mortgage phrases, commute to work, utility funds, family upkeep, and private sanity.

- Affordability – Is the realm you’re inexpensive? This goes past your mortgage mortgage quantity and housing bills. Take a look at the distances you’ll journey to work day-after-day in addition to the price of fuel and utilities within the space. What are the state and metropolis taxes? How a lot is meals and total price of dwelling within the space?

- Employment Alternatives – Are there quite a few employment alternatives within the space? You’ll be committing to dwelling there for at the very least 5 years, when you lose your job, will you be capable to choose up one other job pretty shortly together with your present expertise and the job market within the space?

-

Actual Property Worth – What are the present dwelling costs and native housing developments for promoting and renting? You should utilize on-line sources like Zillow.com to take a look at the realm before you purchase.

- Local weather – How is the local weather all year long? Is it too scorching in the summertime for you, or too chilly within the winter? Consider it or not, issues like this may have an effect on your finances (and your sanity) by affecting utility costs, automobile upkeep, and consumables reminiscent of meals and clothes.

- Distance from Kinfolk – Figuring out how far you’re from household will have an effect on journey bills and the way typically you could want (or need) to journey.

- Tradition and Leisure – If that is essential to you, the place are the libraries, theaters, eating places, and museums situated and the way far are they from the home you’re buying?

- Proximity to Essential Sources – How far will you be to hospitals, police stations, and fireplace stations? Consider it or not, for some insurance coverage corporations it issues how far your own home is to the closest fireplace and/or police station and it’ll generally have an effect on dwelling insurance coverage premiums.

- Native Crime Charges and Statistics – What are the native crime price statistics within the space you’re considering of buying?

Ask your self: can I financially deal with a house?

- Simply because you may qualify for a house mortgage and it is cheaper than renting does not essentially imply you are in the most effective place, financially talking, to personal a house. As a result of you need to purchase the home after which there are plenty of different prices.

Typically, listed below are some indicators you would tackle the fiscal duty of a mortgage.

You’re Debt Free or Nearly There

Taking up a 15-30-year dwelling mortgage when you nonetheless produce other money owed is simply asking to be in debt for the remainder of your life. Earlier than taking over the most important debt you’ll ever have, it’s greatest to do away with all different debt earlier than taking over a mortgage.

Regular Employment

You must plan on staying in your new dwelling for at the very least 5 years, it simply makes monetary sense. So, it’s essential to have steady employment that can be there for at the very least so long as you’ve got your mortgage mortgage.

You Already Have Additional Cash Set Apart

You must have already got extra cash put aside particularly for closing prices and down fee (This could possibly be wherever between 3%-5% of the house’s buy worth – presumably $2000-$10,000), additional money for shifting bills, and a small emergency fund.

You Have Good Credit score

If your credit score rating is respectable and that your credit score report doesn’t include any errors then you definitely’re forward of the sport. A superb credit score rating to purchase a home is at the very least 700-760 or higher.

Step 2 – Calculate affordability

The subsequent step in getting ready to purchase a home is discovering out how a lot you may afford. Affordability is crucial as a result of when you shut on a home, you don’t need to drown in funds and turn out to be “home poor.” Do you know that when lenders have a look at your funds to approve you for a mortgage, they solely have a look at your earnings vs. your money owed?

They don’t think about the opposite issues you must afford. Issues like home-owner affiliation charges (HOA) charges, financial savings for an emergency fund, retirement contributions, utilities, dwelling upkeep charges, way of life and leisure prices, grocery and fuel bills, and so forth.

That is how so many get certified for far more than they will really afford. And why it’s essential to know what your family finances can afford with regards to shopping for a home.

Learn how to Calculate House Affordability

The Fast Math

A fast and straightforward rule some monetary specialists use is to make it possible for your month-to-month mortgage fee doesn’t exceed 28% of your take-home pay.

- For instance, let’s say your month-to-month earnings is $4000 and your bills and payments are $1000. Minus bills out of your month-to-month earnings and multiply that by 28%.

- $3000 x .28 = $840. On this instance, month-to-month mortgage funds (together with insurance coverage and taxes) could be $840. You’d be certain your month-to-month funds don’t go over $840 on this instance.

- Primarily based in your month-to-month earnings, this could guarantee there could be sufficient cash left over in your finances for different bills.

In fact, mortgages and family budgets can get difficult, so right here’s a set of mortgage calculators from Nerdwallet that supply just a few extra metrics.

Step 3 – Verify your credit score

Step one in getting financially ready to purchase a home is to examine your credit score – each your report and rating. Usually, a better FICO credit score rating will provide you with extra dwelling mortgage choices, higher mortgage charges, and decrease down fee necessities.

Folks can qualify for a mortgage with scores as little as 500 however can be required to give you a hefty down fee and have increased rates of interest. Then again, when you’ve got a FICO credit score rating increased than 760, you’ll have entry to the most effective rates of interest, higher mortgage mortgage incentives, and decrease down fee necessities. A decrease rating merely means you will want to have a bigger down fee and a better rate of interest.

And whether it is decrease, you may both determine to attend to purchase a house and work on enhancing your credit score, or pull the set off and pay the upper rate of interest, however realizing your rating (and what it will get you) ought to be one of many first belongings you do when considering shopping for a house.

Learn how to Purchase a Home: Step #4 – Save for a Down Fee

Okay, so you know the way a lot you may afford for a mortgage, however what about that down fee?

If you do not have a big nest egg or a present from relations, it is time to begin trimming the finances and begin saving aggressively. Listed here are just a few of my favourite methods to avoid wasting more cash and methods to make quick money for bigger monetary objectives reminiscent of saving for a down fee.

Automate Your Financial savings

Work out how a lot you may moderately save after bills reminiscent of hire, utilities, groceries, and a little bit of “enjoyable cash.” When you don’t know the place to begin, Elizabeth Warren’s 50-30-20 methodology is a good way to begin.

Ask for a Elevate

Is it time on your annual overview at work? Whereas nerve-wracking, asking (and receiving) a rise in pay is important for monetary well-being, and particularly useful when saving for a house. Simply be sure you automate any improve into your financial savings account, so it doesn’t get spent every pay interval. Even a small 3% price of dwelling adjustment would web $1,500.

Lower Out Pointless Payments

Conduct an audit of all of your payments to determine areas of financial savings. Assessment each expense: each insurance coverage fee, cellphone invoice, and automated subscription, and see the place the areas of price financial savings are. New providers (reminiscent of Rocket Mortgage) even do the heavy lifting for you and might reportedly save customers $250.00 a month.

Discover Distinctive Methods to Earn Extra

Deal with methods to earn extra as a substitute of saving.

- This is the right way to hustle $100-$5,000 bucks.

- Tackle non-creepy facet jobs on craigslist. This is the information.

- 8 methods to shortly construct up financial savings.

- Create a greater finances to make saving simpler.

- The 5 best issues to chop out of your finances.

- Begin your individual enterprise (or a small “facet hustle.”) This is the whole how-to.

- Begin running a blog (here is how I remodeled $160,000 with mine.)

- Qapital rounds up your purchases for you robotically! It actually provides up!

- Make some fast money by filling out surveys in your spare time. Listed here are those I like!

- Plus different methods to construct passive earnings.

- Ask for a increase + different methods to earn more cash at your 9-5

Further House Affordability Sources

- Low wage? No drawback. This is how I purchased my first dwelling making lower than $40k a yr.

- A terrific publish on the right way to save up on your first dwelling on a 5 yr, two yr, and one yr timeline. Superior suggestions by yours really!

- Ideas for purchasing a house with out going broke (significantly in you’re in your 20s!)

- Do not borrow cash from Mother and Dad on your first dwelling buy (here is why!)

Step 5 – Get prequalified

After you hone in on the place you need to lay down roots and take the time to enhance your credit score, it is time to roll up your sleeves and get pre-qualified for a mortgage. That is what you will want so as to begin severely buying with an actual property agent.

How do I purchase a home with a mortgage?

- You may get pre-qualified for a mortgage via a web-based lender like LendingTree, Quicken Loans, or Rocket Mortgage.

- You can even get prequalified for mortgage loans via your common financial institution or via different monetary establishments like USAA, or Chase, or via native credit score unions.

- You may additionally enlist assist by hiring a mortgage dealer. A dealer will do all of the leg work. She or he will discover a lender for you, guarantee all of the paperwork is for the mortgage and title company, and see all the things from the beginning of the mortgage via closing.

- Discover a native mortgage dealer by doing a Google search or asking associates or your actual property agent.

- Irrespective of who you employ on your pre-qualification, at all times ask them if they are going to lock the speed so you may store for a house with out worrying concerning the price going up.

It’s essential so that you can do your individual analysis first since most actual property brokers will not work with you till you have received the pre-qualification letter in hand from a lender.

Step 6 – Store for a House

Okay, so you have gotten prequalified and have your pre-qualification letter in hand. The subsequent step is to seek out an excellent REALTOR® who may help you store and make a suggestion on the house. It is essential to examine the skilled license of the true property agent you select, as it is a testomony to their data and legitimacy within the area.

Beneath are a handful of some “home searching to do’s” that I prefer to advocate to purchasers to make sure they get one thing good.

Construct Your Wishlist

Everybody has a want listing for what they need in a house, whether or not you’re at present wanting, in a house already, or nonetheless renting and compiling an inventory of “prerequisites” for the longer term. I have been making a listing in my head since I used to be ten.

Although I personal a house at present, I nonetheless take into consideration what options I might prefer to have sooner or later.

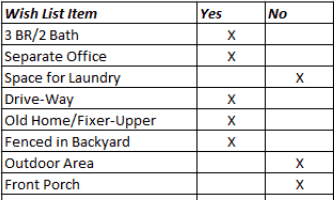

This is a chart of what I had on my want listing again once I purchased my first dwelling in 2013 and the way the house I purchased stacked up.

Clearly, when you watch sufficient home hunters you will know that want lists do not line up with budgets more often than not, however . a want listing may also assist an agent discover properties greatest suited to your wants.

Do Drive-Bys

Home searching is thrilling. Actually. It’s also exhausting. Earlier than you make an appointment to bodily see a house, leverage the web to do detective work. See if any images can be found on-line, have a look at the placement on Google Maps to see what’s close by (when you’re unfamiliar with the neighborhood/road.) These two motion objects alone will go an extended solution to narrowing down your listing.

Then, both earlier than your exhibiting appointment or after, do a drive-by of the house(s) you are interested by. Do one drive-by through the daytime, after which one other at evening for every home.

Neighborhoods can look loads completely different through the day, or you could discover just a few points with the house through the drive-by that weren’t famous/pictured on the web itemizing.

Make a suggestion

Ask your realtor to analysis comparable properties in your space earlier than you make a bid and allow them to advise you on what greatest is smart on your actual property objectives. That is what they’re there for! As soon as your provide is accepted, you will write a examine for the earnest cash and ship that to your agent and work on scheduling your own home inspection.

Step 7 – Due diligence and mortgage underwriting

Put together for an Appraisal

I discussed above the necessity for an appraisal. For the reason that housing crash of 2008, many banks have tightened their lending phrases.

Lenders will not approve a mortgage on a house if it doesn’t appraise for that worth. It does not matter how a lot you are keen to pay for a house, or if the house falls below the quantity you are pre-approved for.

This will frustrate many consumers who fall in love with a house however do not need the money to cowl the distinction between the vendor’s asking worth and the appraisal.

I bear in mind being on pins and needles through the appraisal course of for my present dwelling, however fortunately the house (after renovations) appraised for the house worth + the upgrades, so I used to be capable of get the cash I wanted to renovate.

Get (And Attend!) an Inspection

Inspectors to do a walk-thru of the house after which put together a written report of the findings. As a result of it comes with a report, I’ve recognized many home-owner associates who skipped the inspection. No! Dangerous! Improper! Fully improper.

The inspection is for you. Along with discovering out if something is improper with the house, that is your likelihood to study the place the breaker field is, the water principal, and all acceptable shut-off valves.

Plus, having the potential purchaser there ensures a extra thorough inspection. (Folks behave otherwise after they’re being watched- it’s confirmed.)

- Discover a certified inspector via associates (or Angie’s Listing, like I did)

- Ask to see an instance of the ultimate report earlier than you rent somebody. You need it to be THOROUGH with pages (15+) of documentation and images.

- When you get a report with any potential damages, get estimates for the fixes. It is going to be as much as the vendor to both repair them or present a credit score at closing.

Maintain your cool through the underwriting course of

Underwriting is only a fancy phrase for “qualifying for a mortgage.” You realize, you pre-qualify after which you need to really show you may pay again the mortgage you’re asking for.

Listed here are just a few of the “commonplace” paperwork you can be requested for through the underwriting course of.

- Verify stubs (normally for the previous 30 days.

- W2’s for the final two years.

- Any extra proof of earnings you could have like your inventory portfolio, alimony/little one help no matter.

- Financial institution statements, normally about three months’ value.

- A letter stating your employment and rental historical past for the previous two years.

- A house consumers coaching seminar certificates.

- Tax returns and transcripts (which need to be ordered from the IRS.)

- Copies of all of my hire checks to my present landlord.

And when you’ve got a facet hustle, or freelance or work for your self….

- Put together to point out copies of checks from purchasers along with your tax returns (I printed mine off of my financial institution’s web site.)

- Three months of PayPal statements when you earn cash on-line.

If you’re planning to purchase a house and do not know the place these are, I recommend you find them instantly.

Step 8 – Attend closing

Lastly, after alllllll of the above, the financial institution underwrites your mortgage and provides you the clear to shut. Then you definitely get to attend the closing, signal all of the paperwork, and snag the keys to your first dwelling. This is what to learn about closing:

- Usually, the time limit is about within the provide letter for 30 to 60 days after the provide acceptance. This will change relying on a wide range of components, together with inspections and paperwork processing with the lender.

- No less than three days earlier than closing the closing lawyer will mail the Settlement Assertion, which incorporates data out of your Mortgage Estimate and the Closing Disclosure. Each of those instruments clarify the mortgage phrases, like rate of interest and different prices related to the mortgage (taxes, recording charges, and so forth.).

- Relying on the state you reside in, the closing could happen on the closing lawyer’s workplace or the title firm.

- It’s the customer’s proper to decide on the closing lawyer.

- The closing lawyer charges are included within the closing prices.

Learn how to Purchase a Home: Continuously Requested Questions

How a lot does shopping for a house price?

Typically, everybody accepts just a few expenditures as a part of the house shopping for course of: the down fee, realtor commissions, home-owner’s insurance coverage, and the like.

However there are additionally a number of different charges that may be related to shopping for a house. Notably if you’re shopping for a foreclosed dwelling, getting an FHA mortgage, or lumping renovation prices in with a mortgage through a 203k mortgage.

This is an instance of charges:

- Earnest Cash ($500-$1000)

- House Inspection ($300-500)

- House appraisal ($4-500),

- a HUD Guide payment (provided that doing a 203k renovation mortgage)

- $250 in doc preparation charges to an lawyer at closing

- $15 for a house purchaser’s training class

- $30 in cashier’s examine charges and postage.

For extra on charges associated to purchasing a home, take a look at this prolonged publish I wrote for Opendoor.

How can I get monetary savings when shopping for a house?

Look into Down Fee Help Applications

That is my favourite home-buying tip. Down fee help is how I saved cash at closing after which used the additional money in direction of renovating the home.

Discovering help applications is as simple as googling “[state] down fee help” – so why wouldn’t you?

And very like scholarships for school, there are different avenues of help for nearly everybody. Are you a single mom? A veteran? You could possibly qualify for much more funds!

Enhance your credit score

Figuring out your credit score rating is so essential to potential homebuyers. This little quantity can be what mortgage brokers have a look at when figuring out how a lot you may borrow. Your credit score rating additionally determines what rate of interest you’ll pay.

When you’re seeking to purchase a house however don’t have nice credit score, take into account taking time to pay down your money owed earlier than you make an enormous funding like a house.

Having good credit score can open up your choices so far as mortgage charges and even assist you afford a down fee.

Put down the complete 20% downpayment

When you comply with borrow greater than 80% of the house’s worth, you’ll usually need to pay for personal mortgage insurance coverage (or PMI).

PMI is an additional month-to-month cost is a safety for the lender within the occasion you default in your mortgage.

To keep away from taking over PMI, attempt to save up at the very least 20% of the whole price of the house.

How can I make affording a house a actuality?

Choice #1 – Familial contributions

Do not qualify for any applications or haven’t any out there in your space? Relations can contribute a tax-free reward (As much as $14k per particular person, so $28k for you and a partner) to assist cowl the down fee or closing prices in your first dwelling.

I like to recommend leveraging the cash for closing and shifting prices moderately than factoring it into the financing of the house. This helps make sure you solely purchase a house you may moderately afford.

Choice #2 – Price Store

Maybe you will not be capable to swing an $1800 dwelling buy like I did. Maybe you do not need to! The extra you pay for a house, the dearer it turns into, which is why if you wish to maintain prices low it is essential to price store, from all the things to the mortgage to the house insurance coverage.

Getting the bottom rate of interest in your mortgage is the #1 means to economize in your first dwelling buy.

Choice #3 – Purchase for Now, Not Later

One of the best ways I used to be capable of purchase a house so cheaply is as a result of I purchased an inexpensive home – one thing small and in my finances that I may moderately afford. In fact, this meant exhausting selections, and I do know it’s pretty apparent recommendation, however much less is extra.

How a lot cash do I want to avoid wasting up for a house?

The fast reply is the more cash it can save you, the higher! However the deeper reply actually relies on your specific home-buying scenario.

Down Fee/Sort of Mortgage

- The scale of your down fee will depend upon the scale of your mortgage.

- Instance: the mortgage you’re making an attempt to qualify for is $250,000, and you must have a 3.5% down fee. You’ll want $8750 as a down fee.

- Nerdwallet has a down fee calculator you need to use to present you an thought of how a lot you could want.

Closing Prices

- Closing prices differ however are normally 3-5% of the price of the mortgage quantity.

- Instance: Let’s say the mortgage is $250,000, your closing prices (administrative charges) could be $7,500 to $12,500.

- On some loans, the closing prices roll into the mortgage mortgage quantity, and for some, the vendor pays some or the entire closing prices.

Earnest Cash

- Earnest cash is normally 1-2% of the acquisition worth of the mortgage. This cash conveys to the vendor you are critical about buying their property!

- The customer writes a examine to the vendor at first of the contract. Then the dealer or title firm holds the cash for the rest of the sale.

- If all goes properly, the cash goes towards the closing prices or brokerage charges at closing.

Money Reserves

- Some lenders could require consumers to carry sufficient cash in checking to cowl the mortgage funds for the primary months of the mortgage.

- For instance, your month-to-month mortgage funds are going to be $1000/month. At closing, lenders will count on to see $1000 – $6000 within the financial institution.

- Not all lenders would require this, so it’s essential to ask upfront.

Full publish on how a lot to avoid wasting up for a house is right here.

How a lot does dwelling upkeep price?

House upkeep prices are the one issue that most individuals are inclined to neglect when getting ready to purchase a home. Monetary specialists agree on saving 1-3% of the acquisition worth of your own home yearly, for starters. For instance: You buy your own home for $185,000. This implies you need to be saving at the very least $1850 per yr for upkeep ($155/month).

When you’re buying an older home with older home equipment, you could want to avoid wasting up more cash earlier than buying your own home. If family home equipment are 10+ years previous on the time of buy, count on to interchange or restore them throughout the subsequent 1-5 years. Particularly big-ticket objects like air-con, heating, roofing, fridges, electrical, plumbing, and so forth.

- Because of this a radical, detailed dwelling inspection can provide you an thought of how a lot work might have to enter the house before you purchase.

- Try how a lot I spent on the renovation of my first dwelling – a 1940’s fixer-upper – to get a ballpark of how a lot beauty upgrades can price.

- Look into completely different financing choices, reminiscent of a 203k mortgage which can combine renovation prices into your mortgage.

Learn how to Purchase a Home: The TL:DR

Financially talking, when you dwell in an space the place it’s cheaper to hire, and you may afford each a mortgage and dwelling upkeep (about 1% of the acquisition worth of your own home annually, in accordance with The Steadiness)…then shopping for is healthier.

However here is the factor – homeownership is not a one-size-fits-all deal. And whereas I feel proudly owning a house (particularly as an funding) will be nice on your funds, if it does not jive together with your values or way of life or your post-college plans, then what is the level?