All people reaches some extent of their life or enterprise enchancment as soon as they need a bit additional cash. 51.3% of People say they’ve taken out a non-public mortgage to enhance their funds.

Loans sometimes embody a complete lot of phrases and situations referring to how that you must use them; must you need one factor that gives a bit additional flexibility and freedom, you may want to consider taking out a non-public or enterprise line of credit score rating.

What’s the excellence between a line of credit score rating and a mortgage, and which one is greatest for you? This info will let you understand each half it’s important know.

How Does a Personal Line of Credit score rating Work?

A line of credit score rating is as soon as you are taking out a tough and quick amount of money from a monetary establishment or lending institution. You could draw upon this money as needed to pay for numerous personal payments.

Compensation Constructions

In some methods, a line of credit score rating (LOC) capabilities like a financial institution card. Within the occasion you are taking out a line of credit score rating for $50,000, nevertheless you don’t use the money, you’ll not pay any curiosity. As an illustration a few months later you make the most of $10,000 to get a model new vehicle. You’ll then solely should pay curiosity on the $10,000. The reimbursement development may also be very like a financial institution card. Each month the lending firm will ship you a press launch alongside together with your stability, curiosity summary, and minimal price due. To remain in good standing and steer clear of the hazard of getting your LOC revoked, you might be anticipated to pay the minimal every month.

Secured vs. Unsecured

A line of credit score rating shall be taken out in one in every of two strategies. Having a secured LOC entails using collateral, resembling your personal residence or enterprise. These sometimes embody lower charges of curiosity because of the lending institution can take over your property should you default on reimbursement.

An unsecured line of credit score rating has larger charges of curiosity because of there the lender has nothing to seize should you be unable to pay once more the street of credit score rating. One in all these LOC is normally harder to amass. When in quest of an unsecured line of credit score rating, you need to to level out proof of excellent credit score rating.

Professionals of a Personal LOC

There are a variety of benefits for getting a non-public line of credit score rating, the plain being flexibility. That’s all through all areas of the borrowing course of, along with reimbursement, utilization, and the amount.

With a credit score rating line, you solely borrow what you need, fairly than being restricted to a tough and quick amount. It’s wonderful for long-term duties or payments the place you’re unsure of the final word costs. It’s normally an excellent risk for shortly supplementing your funds all through an unanticipated life event or emergency.

Getting your money is quick and easy. As quickly as you’re authorised for a LOC, you must have limitless entry to your obtainable funds. This allows you to use them as desires come up, fairly than making use of each time you need cash.

A line of credit score rating may also be a renewable provide of funds. Going once more to the auto occasion, while you pay once more the $10,000 you borrowed, you’ll as quickly as as soon as extra have a $50,000 credit score rating prohibit.

Cons of a Personal LOC

There are a few downsides when taking out a non-public line of credit score rating. Even with a protected line of credit score rating, charges of curiosity are typically larger than you’ll get with a non-public mortgage. As well as they’re more likely to have variable costs vs. mounted Annual Share Expenses (APR). Which means you might end up paying once more larger than you initially meant.

Accounts embody annual service costs, regardless of whether or not or not you’re using the money or not.

In addition to, they aren’t probably the most appropriate alternative for people with poor spending habits as they allow flexibility for overspending. Although they are often utilized as a short-term cash complement, that’s sometimes a dangerous line to walk and unsuitable for attaining long-term financial stability.

Personal Line of Credit score rating vs. Mortgage

Loans and credit score rating traces are kinds of debt issued by banks or lending firms. Every mortgage and line of credit score rating kinds depend on the meant use, your financial standing, and credit score rating historic previous. Your relationship with the lending institution will even play a job in what’s on the market to you.

Loans are granted for one-time utilization and have a tough and quick reimbursement time interval, whereas traces of credit score rating will be utilized when and the way in which you please. With credit score rating traces, lending firms monitor your utilization and credit score rating standing. In case you have not used your LOC shortly, they could reduce or shut it.

Like LOCs, loans shall be secured or unsecured. All personal loans are unsecured because of they don’t appear to be backed by collateral. In distinction, a home or vehicle mortgage is assessed as a protected mortgage and often consists of stipulations on how one can and might’t spend money.

Within the occasion you are taking out a home mortgage for $500,000 nevertheless solely end up using $450,000, you’ll not have the flexibility to spend the alternative $50,000 getting a model new vehicle.

A non-public mortgage provides the freedom to utilize the money as you see match. Nonetheless, because it’s a should to take every thing of the mortgage straight, you might be incurring costs from day one. Even when lots of the money is sitting in your checking account prepared to be used, you might be anticipated to pay the minimal principal and curiosity costs every month.

With a line of credit score rating, you must have a bit additional freedom and solely pay costs on what you make the most of. Even a protected line of credit score rating is simply not linked to a specific operate and is sweet for frequently use and stunning emergencies.

When to Apply for a Personal Line of Credit score rating

There are three major causes to make use of for a non-public line of credit score rating vs. a mortgage.

1. You’re not sure how quite a bit money you might have considered trying

Usually, you gained’t have the flexibility to foretell how quite a bit each half goes to worth. A non-public line of credit score rating offers you the financial flexibility to utilize what you need fairly than being tied proper all the way down to a sure amount. They’re moreover an efficient solution to consolidate your debt.

2. Your payments may be unfold out by way of the years

You could want many different payments growing, resembling residence enchancment duties or a significant life event like a wedding. A line of credit score rating is one factor you could possibly entry repeatedly. Use it for one expense, pay it off, and have your complete amount ready for the following issue life throws your method.

3. Your credit score rating is in good state of affairs

Within the occasion you propose to make use of for an unsecured personal line of credit score rating, it is very important have good credit score rating. Having weak credit score will impact your means to get authorised and depart you paying steep charges of curiosity.

When to Apply for a Personal Mortgage

Relying in your situation, getting a non-public mortgage is more likely to be the upper risk. Listed below are two causes to ponder getting a mortgage.

1. You understand how quite a bit it’s important borrow

As an illustration you may need employed a company to remodel your kitchen. You notice exactly how quite a bit each half will worth and haven’t any completely different payments growing that require additional cash. Loans embody additional flexibility in how quite a bit you’ll be capable of borrow straight and reduce reimbursement costs.

2. You want to prohibit the amount of debt you sort out

When you already know that you just are more likely to overspend when money is on the market, a mortgage is more likely to be the upper risk. The money focuses on one expense versus allowing flexibility which can end in additional spending. Loans moreover are more likely to have mounted charges of curiosity and fewer of an instantaneous impression in your common credit score rating ranking.

Enterprise Line of Credit score rating vs. Mortgage

A enterprise line of credit score rating is just like a non-public line of credit score rating. The precept distinction is that it’s meant for short-term desires. It is advisable use a enterprise line of credit score rating as needed, so long as you faithfully pay your month-to-month minimal and any associated annual costs.

Enterprise LOCs are an excellent risk for startups that should have flexibility referring to cash flow into. In case your small enterprise is already established and likewise you’re in quest of a additional in depth credit score rating line, you’ll be capable of put up collateral to get a secured line of credit score rating. This may embody enterprise precise property, additional fleet cars, or inventory.

One enterprise line of credit score rating and mortgage distinction is a mortgage is designated for a specific operate. Prolonged-term loans are geared within the course of investments and completely different payments that take time, resembling an office rework. Temporary-term enterprise loans have a quick reimbursement schedule and are meant for quick desires, resembling improve inventory.

When You Must Apply for a Enterprise Line of Credit score rating

There are a few components to ponder when making use of for a enterprise line of credit score rating vs mortgage.

1. You need ongoing entry to cash

In case your small enterprise goes by a stage of change—enlargement, redesign, or restructuring—you may should entry cash with some irregularity. New payments and stunning costs can throw off your common funds. A line of credit score rating gives you peace of ideas, understanding the cash is there should you need it.

2. You need price flexibility

With a enterprise line of credit score rating, you’ll solely need to fret about repaying the minimal each month. That’s utterly completely different from a mortgage the place you may need a principal together with curiosity and a tough and quick reimbursement time interval. A enterprise LOC offers you the pliability to provide consideration to your small enterprise now and worry about full reimbursement later.

When You Must Apply for a Enterprise Mortgage

Enterprise loans would be the fashionable different relying in your agency’s desires and stage of enchancment.

1. You understand how quite a bit it’s important borrow

Perhaps you’re together with a model new precise property holding to your small enterprise. Since you don’t require frequent entry to additional funds, a enterprise mortgage is more likely to be the upper route. Your charges of curiosity will sometimes be lower, and you’ll not have to worry regarding the annual costs associated to a LOC.

2. You want set reimbursement costs

Enterprise loans sometimes embody a tough and quick APR. You could choose your reimbursement time interval, so that you already know what you’re paying extra time. That’s terribly helpful when attempting to funds on your small enterprise.

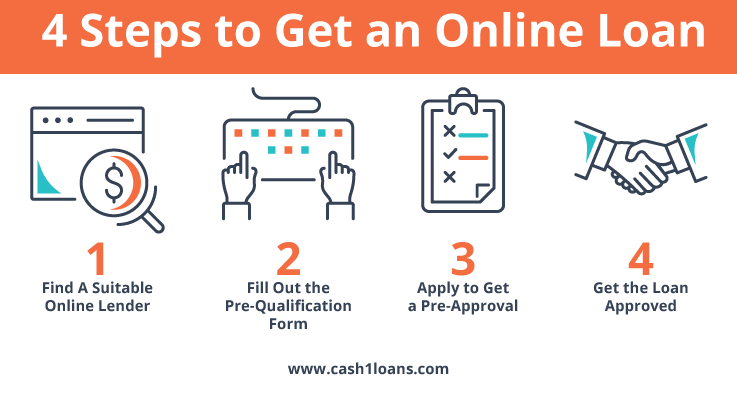

Simple strategies to Apply for a Personal Line of Credit score rating

You’ll have two points when you apply for a non-public line of credit score rating: your credit score rating historic previous and a secure credit score rating ranking. Previous that, the making use of course of is just like making use of for a non-public mortgage.

Take some time to ponder which lender to borrow from. Look into their charge development, annual costs, and lending limits. How quite a bit you’ll be capable of borrow will rely intently in your credit score rating ranking.

As quickly as you’ve obtained chosen a lender, it’s time to fill out the making use of. Many lenders will imply you may apply on-line and even over the cellphone. After getting been authorised for a line of credit score rating, your funds may be accessible in as little as one enterprise day.

Must I Get a Mortgage or Line of Credit score rating?

Deciding whether or not or to not get a line of credit score rating vs. a mortgage relies upon why you need the money and the way in which you propose to utilize it. There are execs and cons to each, along with utterly completely different charges of curiosity, accessibility, and spending freedom.

In case you take a take a look at long-term flexibility and unknown costs, a line of credit score rating is an efficient risk for you or your small enterprise. For a lot of who know exactly the place the money goes and want a safe and glued reimbursement risk, a non-public or enterprise mortgage is normally the upper risk.

Within the occasion you keep in Utah, Idaho, Kansas, Louisiana or Missouri, CASH 1 would possibly allow you to with your entire line of credit score rating desires. Apply on-line or over the cellphone.