Must I Apply for a Mortgage On-line or In Particular person?

Deciding whether or not or not you have to try making use of for a mortgage on-line or particularly individual typically is a superior course of, significantly for individuals who discover themselves new to the financing course of. On-line lenders have a far more streamlined course of and may present additional achievable qualification requirements. Listed are some points it’s a must to study making use of for a mortgage on-line vs. particularly individual, after which resolve which is perhaps increased for you.

APPLY NOW

What Is an On-line Mortgage?

For a web-based mortgage, potential debtors can apply on-line with out submitting explicit individual features to standard banks. The net mortgage permits the borrower to pre-qualify for a mortgage with a variety of lenders with out their credit score rating score being affected by exhausting inquiries. On-line loans often have moderately extra versatile phrases and circumstances than in-person loans.

Moreover they’ve simpler utility processes, faster processing situations, and further aggressive charges of curiosity. Yow will uncover a variety of lenders who won’t value you any processing cost in your mortgage utility.

How Does a Mortgage On-line Work?

You’ll have the ability to entry on-line loans from wherever with a safe internet connection, smartphone, or laptop computer pc. You’ll have the ability to have a hassle-free time going by all their choices, phrases, & circumstances sooner than deciding. All lenders could have an option to get hold of the making use of sort, which you’ll be required to fill out and submit digitally.

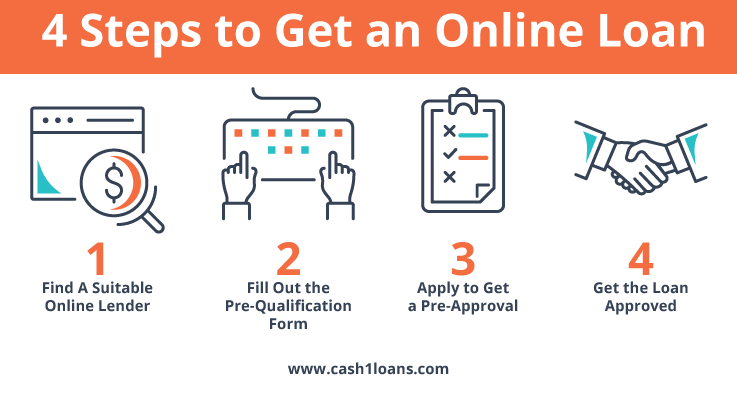

What Is the Course of for Making use of for an On-line Mortgage?

Listed are some components you’ll need to take into consideration when making a web-based mortgage utility:

Know your purchaser

KYC is a obligatory part of each sort of financial transactions. You’ll want to add the KYC paperwork digitally to the respective lender’s portal for personal on-line loans. The lender will then authenticate your paperwork and inform you regarding the approval of your mortgage.

Processing time

The lender will affirm your eligibility after you should have uploaded the required paperwork. As shortly as a result of the mortgage is accepted, the mortgage amount is disbursed immediately to your associated account. The processing time for on-line loans has diminished drastically.

APPLY NOW

When to Get an On-line Mortgage

Making use of for a mortgage particularly individual is tedious, prolonged, and aggravating. On-line loans are additional useful and embody different perks, making them a preferable different for lots of debtors. We’ve listed a few causes you have to take into consideration whereas making use of for a mortgage on-line:

Pre-qualified loans

Many on-line lenders allow debtors to amass pre-approved or pre-qualified loans with one tender credit score rating check in accordance with their credit score rating score & borrowing needs. Do you have to’re unsure of the mortgage amount or aggressive charges of curiosity you’ll qualify for, choose a web-based lender that offers pre-qualified loans.

Unknown lenders

Some standard banks present lower charges of curiosity or phrases & circumstances to prospects with monetary establishment accounts or not lower than some type of care for the institution. When you do not need an present account with the monetary establishment, then on-line loans could also be increased for you.

Quick cash

On-line lenders often have a faster processing or approval time than non-public loans. In case you might be lucky and have credit score rating score & historic previous, it’s potential you’ll get accepted for the mortgage the an identical day you apply.

Low credit standing or small credit score rating historic previous

Getting accepted for a bodily mortgage could also be robust in case you’ve got a horrible credit standing or credit score rating historic previous. On-line lenders check your credit score rating score nevertheless have a far more relaxed scrutinizing protection. This suggests your mortgage request can get accepted no matter your credit score rating report.

Execs & Cons of Making use of for On-line Mortgage

Is it increased to make use of on-line or particularly individual? It’s a debate that every borrower has every time they need to apply for a mortgage. Like each half else, on-line loans have their advantages and disadvantages. On this text, we’ll break down the professionals & cons of constructing use of for a web-based mortgage:

Execs of constructing use of for a mortgage on-line

Consolation

As talked about beforehand, with on-line loans, chances are you’ll apply from wherever. By the utilization of cell apps or browser variations, it’s only some clicks away. You’ll have the ability to add the required paperwork on-line with out worrying about bodily submission. Implementing superior devices like Artificial Intelligence to check your eligibility expedites scrutinization.

Pre-approval

Some on-line lenders current pre-approved non-public loans. Which implies that based totally in your income, credit score rating report, and required mortgage amount, the lender determines a sure amount chances are you’ll get after you current the minimal required documentation. As a result of the eligibility has already been established, the processing time reduces, and the lender can immediately disburse the mortgage money to your account.

Cons of constructing use of for a mortgage on-line

Smaller most limit

As a first-time borrower, it’s potential you’ll uncover that your most limit is insufficient to cowl all your payments on account of the utmost amount chances are you’ll mortgage is smaller than what standard banks present.

Safety of data

Be careful regarding which on-line lender you choose. Info hacking and scams are attainable, as the entire course of is digital. Selecting a lender who offers you right security and has real opinions and good buyer help is essential.

Are the Loans of On-line Lenders Reliable?

On-line loans may appear harmful and insecure, nevertheless with right evaluation, yow will uncover fairly a couple of respectable on-line lenders. Take a look at their federal registration to substantiate whether or not or not a web-based lender is safe and legit. You’ll have the ability to usually uncover an internet web page dedicated to the registration numbers of a web-based lender on their official web page. In distinction, others put it throughout the footer a part of every internet web page on their web page.

What Is a Mortgage In-Particular person?

An in-person mortgage is a type of mortgage that requires visiting a lender’s brick-and-mortar office pretty than making use of on-line. These loans are equipped by standard financial institutions, akin to banks & credit score rating unions.

How Does In-Particular person Mortgage Work?

In-person loans are traditionally used for additional vital payments like dwelling or auto loans. Which implies that the approval course of is stricter & requires you to submit additional paperwork so the monetary establishment or union can affirm a person’s means to repay the entire amount.

Straightforward strategies to use for an in-person mortgage?

For an in-person mortgage, it’s a must to go to the monetary establishment, communicate to an employee to see for those who could get a mortgage collectively together with your credit score rating score and historic previous, and fill out their mortgage utility sort. After getting stuffed out the mortgage utility sort, the lenders will inform you in case your mortgage has been accepted after the scrutinization.

The strategy is prolonged, nevertheless it’s potential you’ll uncover lower charges of curiosity than on-line loans.

When to Get a Mortgage in Particular person?

Bodily loans present way more privateness as as compared with on-line loans. In case you might be unsure about sharing your social security group, selecting a bodily mortgage is finest for you. Additionally it is preferable for those who want to care for the lender nostril to nostril as a substitute of trusting the digital course of.

Execs and Cons of Making use of for a Mortgage in Particular person

Particularly individual, loans have perks and disadvantages, most of which we now have talked about beneath.

Execs

If you’ve acquired dealt with the respective monetary establishment, it’s potential you’ll get lower charges of curiosity and a smaller utility cost. When you want the protection of dealing with the mortgage officer face-to-face, then bodily loans are increased for you. Moreover it’s less complicated to ask the lenders questions whenever you fill out the making use of sort.

Cons

You’ll not uncover pre-approved loans with a monetary establishment or credit score rating union, which suggests the qualification course of is approach harder to crack, and the processing time will also be longer. When you want the cash shortly, in-person loans might be not for you. Moreover, it would be best to go to the monetary establishment to complete the form and submit the bodily paperwork.

Is It Faster to Apply for a Mortgage On-line or in Particular person?

On-line loans are faster in getting accepted. On-line loans have additional generous qualification requirements, and loads of lenders solely require you to submit some vital documentation. This takes a lot a lot much less time than the tedious strategy of submitting fairly a couple of paperwork bodily throughout the monetary establishment or credit score rating union. If all your paperwork are right and also you’ve acquired an sincere credit score rating score & historic previous, then it’s potential you’ll even get accepted inside 24 hours of constructing use of for the mortgage.

Bodily loans have a far more extended processing interval, and their phrases to qualify for a mortgage are moreover stricter. So, selecting a web-based mortgage is also increased for those who’d like quick cash.

APPLY NOW

Conclusion

Lastly, discovering an acceptable borrowing approach depends in your credit score rating score, month-to-month income, financial requirements, and accessibility. If you’ve acquired credit score rating score, chances are you’ll choose each answer to use for a mortgage and have a extreme chance of getting accepted. If you’ve acquired a horrible credit standing or wouldn’t have credit score rating historic previous, chances are you’ll get accepted by on-line lenders additional shortly than bodily loans. Analyze your state of affairs completely after which resolve which chance suits you increased. Every on-line and bodily loans have their professionals & cons, so you’ll not be missing out on any perks by choosing one amongst them.