So, you might have a low credit score rating.

Whilst you might really feel embarrassed and even ashamed, the reality is, it occurs to a variety of us.

Constructing and sustaining your credit score rating has by no means been extra essential. With the housing market unable to discover a regular level of progress for the reason that collapse in ’08, and the financial system rising at its slowest tempo in historical past, having available credit score and the choice to buy bigger ticket gadgets for a decrease rate of interest is a should.

Whether or not you fell right into a spot of unhealthy monetary luck otherwise you simply didn’t take the time to plan your funds, what occurred up to now doesn’t matter. What you want to do now could be work out a solution to transfer ahead.

However many People assume their credit score rating relies on their previous credit score historical past and there’s nothing to do to alter it. However the truth is, there are a number of totally different strategies you should utilize to boost your credit score rating, even when your present credit score rating is unhealthy or not so nice.

In case you have unhealthy money owed, these gained’t final endlessly both. Although it might take as much as 7 years relying in your state, they are going to fall off.

in the event you’re on the lookout for concepts to up your credit score rating as quickly as potential, we’ve received some straightforward suggestions so that you can make the most of.

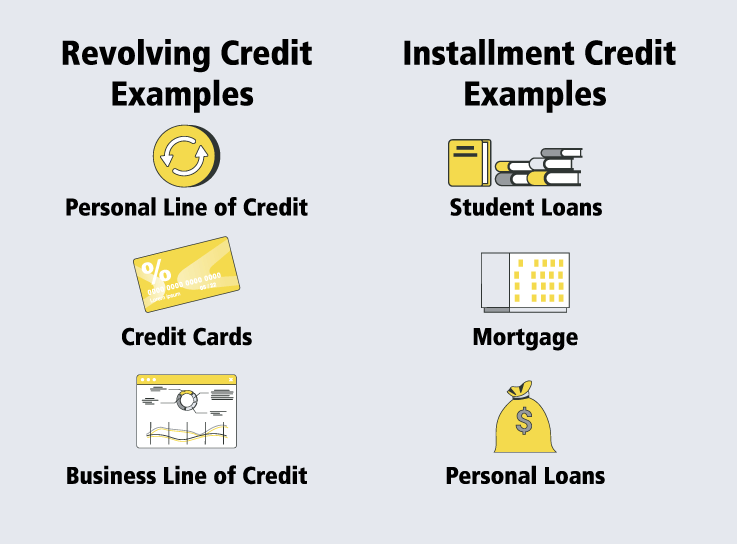

Work out Your Credit score Utilization

Step one to fixing up your low credit score rating is to find out precisely how a lot credit score you utilize.

I do know, I do know. That sounds difficult. Nevertheless, it’s quite simple, and it’s important to growing a correct funds that works.

Your credit score utilization is your ratio between what credit score you might have accessible (on all playing cards or accounts) and the quantity you’ve used. Divide your balances by your credit score limits and multiply it by 100.

Ideally, that quantity ought to be beneath 30%. Nevertheless, in case your credit score is lower than wholesome, you can begin taking different steps to repair it.

Pay Your Payments on Time

This looks like it’s a no brainer, however there’s no time like the current to get to work on repairing your low credit score rating. The simplest approach to try this is to verify your payments are paid on time.

Paying your payments on time is essential, particularly whilst you’re within the technique of fixing your low credit score rating. Whilst you’re juggling and making an attempt to maintain up with all these funds that you simply fell behind on (or consciously stopped paying – it occurs to one of the best of us), something you fall behind on can smash your progress.

By lacking invoice funds, your rating will proceed to drop. Even in the event you’ve figured your funds out and are sitting on a money mountain, you could possibly nonetheless miss out on alternatives for properties and automobiles.

Once we say each invoice, we imply each invoice. Skipped a cable fee? Pay it up as quickly as potential. It might go to collections (in excessive circumstances), which may very well be a further ding in your credit score report.

Use a Calendar

Should you’re planning on making a giant buy sooner or later, you want to plan that out. Give it a brief time frame, or else it might be famous in your credit score report.

For each software for credit score you’re taking out, your credit score rating will dip barely. This occurs as a result of, in the event you’re making a number of credit score functions, there’s a fairly strong likelihood you need to use much more credit score.

Typically, particularly with massive purchases like vehicles or home, they’ll account for the truth that you’ll seemingly use a number of functions, even in the event you solely take out one mortgage.

Your FICO rating will ignore functions made 30 days earlier than the rating was set, and any which are older than 30 days and made in a brief period of time as one inquiry.

Don’t Run from Your Outdated Debt

It may be scary having outdated money owed in your credit score report, particularly in the event you’re onerous at work taking steps to repair your low credit score rating. Nothing’s worse than making use of for an residence, dwelling mortgage, or something that requires a credit score verify whilst you know you might have horrible debt that might’ve been averted.

Simply because you might have one thing paid off doesn’t imply you want to struggle to have it eliminated out of your report. In fact, detrimental gadgets will negatively have an effect on your credit score rating.

Nevertheless, there are some good issues in your report that you simply’ll need to make the most of. In case your debt is dealt with nicely and paid on time, it would profit your rating the longer you retain it on there.

Subsequently, it is best to preserve your outdated money owed and accounts in your report in the event you can. Moreover, take into account protecting accounts open if you’ve had a great reimbursement file with them.

Get Rid of Credit score Card Balances

Eliminating your bank card balances is a implausible approach to enhance your credit score rating with ease.

In fact, this solely works if in case you have a number of bank cards open. The balances which are best to eliminate are these which are small, so if in case you have many small balances unfold out between quite a few playing cards, you’ll profit essentially the most from paying them off first.

A motive this helps is that your credit score rating takes under consideration what number of playing cards you might have open, and what number of balances you might have. This contributes to your total credit score utilization, and might shortly decrease your rating in the event you’re not cautious.

The simplest solution to take care of it? Do exactly that: take care of it.

Take all of the playing cards which you might have balances on and simply pay them off. Should you can’t pay them off in a single lump sum, don’t fear: pay them off as you may. Save the cash and pay them off totally.

After that, preserve one or two playing cards which are in good standing. Go forward and use these for emergencies solely, or else you’ll danger getting caught up within the cycle of debt and destruction. That doesn’t pay, particularly if you’re making an attempt to enhance that low credit score rating of yours.

Preserve Observe of Your Spending – It Will Enhance Your Credit score

Let’s begin with the fundamentals. The primary and smartest thing you are able to do is preserve monitor of your spending. Preserve a funds and be sure to find out about all of the transactions that happen together with your checking or financial savings account. It’d shock you to study that as much as 25 million households in the USA live paycheck to paycheck, and a big share of these don’t preserve monitor of their spending.

Even when your bills are tight, it’s in your finest curiosity to verify your spending towards your financial institution statements to be sure to don’t incur any undesirable or mistaken expenses.

Most individuals assume faulty expenses solely occur in circumstances of id theft, however there are various alternatives for incorrect expenses to look in your assertion, and contribute to the potential for an overdraft, which will get reported to the credit score firms. As an illustration, in the event you purchase an article of clothes from a small enterprise utilizing your bank card or debit card, it isn’t unusual for these expenses to mistakenly stay in your assertion.

Small companies usually don’t deal with very many returns and will not be nicely practiced within the technique of reversing a cost to your card. This is only one instance of why it’s all the time good to maintain monitor of your spending.

Rebuild Your Credit score by Not Exceeding Your Restrict

One other primary tip is to not exceed your credit score limits. Appears apparent, however many individuals will likely be near their credit score restrict and incur a cost that places them over the restrict. This will get reported to the credit score rating firms and influences your rating.

What Can You Do to Construct Your Credit score Rating Quick?

Repay your stability each month. Maybe you felt it’s higher to easily pay for the whole lot with a verify or debit card and never incur expenses in your bank card in any respect. That’s completely legitimate, however you may construct your credit rating slowly and intentionally by charging a couple of issues to your card after which paying it off each month.

Cease charging.

If you have already got a card with a big stability on it, cease charging issues to that card and start eliminating your stability by making funds that exceed the minimal due. By decreasing your stability, you may assist construct your credit score rating.

Don’t max out your card.

In case you have a thousand-dollar restrict in your card, don’t go above eight hundred in expenses. It’s finest, after all, to maintain your stability at zero, however in the event you really feel you could make a cost to your card, keep beneath the credit score restrict. This may assist improve your credit score rating.

Pay your invoice on time. Finest to pay your invoice as quickly because it is available in, however of you may’t, on the very least make that fee by the due date. Late funds are all the time reported to the credit score rating firms and so they can have a detrimental impact in your credit score rating.

Keep away from retailer card accounts.

They have an inclination to return with the best rates of interest and least advantages. Even in the event you store at that retailer, use your personal bank card for purchases. In fact, this isn’t the identical as a shopping for membership card, and you’ll want to be certain you understand the distinction. Shopping for membership playing cards offer you rewards for spending at their retailer, however it isn’t an precise cost account. Even if you’re good together with your retailer account, most shops don’t report your exercise to the credit score firms except it’s for detrimental causes. Fortuitously, most stare cost accounts are being phased out and can quickly develop into the product of a bygone period.

Should you’ve had a bank card for six months to a 12 months, take into account asking for an elevated line of credit score. Even in the event you don’t use it, a rise in credit score restrict is an effective signal to the credit score rating firms who will make an observation of such in your report. Don’t be nervous about asking and don’t really feel unhealthy in the event you get turned down. This simply means they don’t really feel snug elevating your credit score restrict but. However right here’s a tip: if you’re turned down as we speak, wait a month and name again once more with the identical request.

Bank card firms need to elevate your credit score to entice you to spend extra. We advocate that you simply don’t, after all. Elevating your credit score restrict appears to be like good in your report, however in the event you cost that a lot to your card, then you might be simply hurting your self. Ask for an elevated restrict after which don’t spend it. This helps improve your rating.

Repair Your Low Credit score Rating Immediately!

Credit score might be tough to determine, particularly in the event you aren’t financially-minded. Nevertheless, it’s essential to maintain your funds so as, or else you run the chance of your credit score rating crashing once more.

The simplest methods to repair your credit score rating contain paying off your excellent money owed and ensuring you proceed to pay your payments on time. Easy stuff, actually!

We hope you discover the following tips useful. CASH 1 is concerned about serving to you out throughout troublesome monetary circumstances. In case your credit score is just not so nice, come see us about similar day loans or Payday Loans in Las Vegas.