Do you’re feeling overwhelmed by the entire funding decisions and strategies within the market instantly? Schedule a reputation with Bay Degree Wealth to study the way in which we are going to provide help to overcome these obstacles and start producing returns.

How usually should you rebalance your portfolio?

You’ll want to normally rebalance your portfolio every quarter to yearly. Whichever approach you choose, rebalancing works most efficiently whilst you set tips to your self and comply with them. Consistency will make it simpler to rebalance on the right time.

However, these are three further explicit indicators to watch for that time out you have to rebalance:

1. When the market goes up or down.

You attainable take into account that the stock market took a nosedive when the COVID-19 pandemic hit. At Bay Degree Wealth, our rebalancing approach in the mean time involved encouraging our customers to utilize this opportunity to buy shares at a decrease price, not on account of now we have been attempting to time the market, nonetheless on account of the equity portion of the portfolio went down and our rebalancing approach immediate we buy. This effort took a strong stomach to implement. For individuals who didn’t have cash to utilize to purchase equities, it required selling safer, mounted earnings (bonds) and searching for riskier equities (shares). The essential factor in situations like that’s to avoid slipping into panic mode and comply with your approach.

You’ll have the ability to resolve to rebalance primarily based totally on whether or not or not a particular asset class goes up or down by as a minimum 5 to twenty%. Setting these kinds of parameters holds you accountable to analytics pretty than emotion. That being acknowledged, deliberate to contact your financial advisor any time you experience a critical event in your life that may change your financial state of affairs.

2. Whilst you acquire (or spend) an enormous sum of money.

For individuals who the entire sudden come into further money resembling an inheritance or an enormous bonus, you have to use these funds to rebalance your portfolio. That’s usually preferrred as it could imply you may rebalance with out having to advertise shares and acknowledge taxable optimistic elements. Equally, in the event you ought to take money out of your investments, that’s moreover a chance for portfolio rebalancing.

3. Whilst you experience an infinite life change.

Milestones in life like searching for a home, having a toddler, or coming into retirement usually signal that it’s a superb suggestion to rebalance your portfolio on account of your earnings, along with your financial desires, may need modified.

Skilled Tip: Even when your portfolio includes solely shares, you’ll nonetheless have to bear in mind rebalancing it every so often. A diversified portfolio should embrace quite a few asset programs, resembling big and small cap shares. These asset programs perform in any other case, so you have to usually modify the amount of each inside your portfolio. Returning to the occasion of the pandemic, big cap know-how shares carried out correctly all through this time, whereas small cap shares didn’t fare as positively. We purchased the higher performers and purchased the lower performers as part of our rebalancing approach.

Why is portfolio rebalancing important?

The Greek thinker Heraclitus acknowledged, “The one mounted in life is change.” The an identical holds true for the stock market. As market conditions evolve, your funding portfolio will look utterly totally different at quite a few elements inside the 12 months. Portfolio rebalancing is an outstanding strategy to ensure your funding allocation stays inside your menace tolerance stage. This tactic moreover helps you promote extreme and buy low to maximise your wealth, and it might presumably open up alternate options to spend cash on among the many wealth-preserving tax-advantaged accounts we’ll go over beneath.

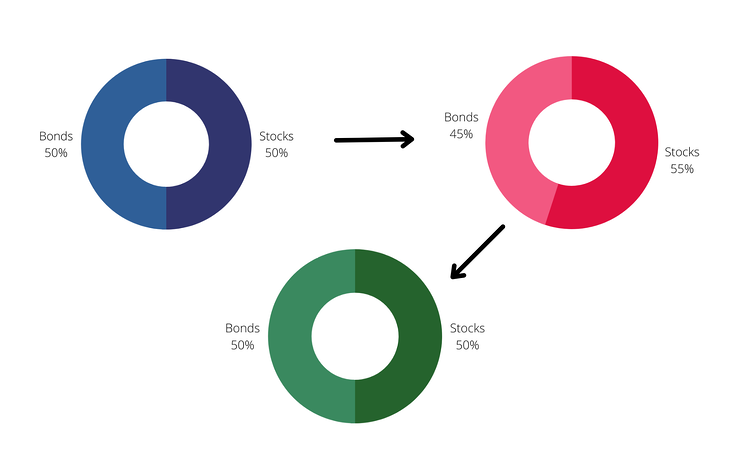

As an illustration, for many who make investments 50% of your portfolio inside the stock market and the other 50% in bonds, then shares go up by 10%, your portfolio may be out of stability and not comprise a 50/50 reduce up. As a substitute, you’ll now have 55% publicity to the stock market, and your portfolio may be invested in a further aggressive methodology than it was sooner than.

On this case, for many who had a rebalancing philosophy to adjust to, it can data your subsequent switch: Seize the prospect to advertise 5% of your shares at a extreme worth, rebalance your portfolio (since you solely need 50% invested inside the stock market) and buy into safer belongings to take some menace off the desk.

Have to create a financial plan that helps you save as quite a bit as attainable at tax time? Schedule a reputation with a Bay Degree Wealth advisor instantly to get started.

5 Tax-Setting pleasant Funding Accounts To Ponder When Rebalancing

You on a regular basis have to take taxes into consideration when rebalancing. It’s important to rebalance in a strategy that preserves your wealth—nonetheless you perceive that’s less complicated acknowledged than carried out, significantly in relation to taxes. A way to economize that doesn’t require you to repeatedly observe your payments is thru the usage of tax-efficient investments.

A tax-efficient technique helps lower the amount of tax you pay in your monetary financial savings and investments, and it’s an integral part of your financial plan. Essential issue to remember about tax-efficient investments is that there are many decisions, and some is also further suited to your state of affairs than others—so be thoughtful concerning the place you’re putting your money. (Tweet this!)

1. Employer-Matched 401(okay)

Many employers current this type of retirement plan, which lets you contribute a portion of your pre- or post-tax earnings. Your employer will then match a sure amount of your contributions (the nationwide frequent is barely over 4%).

One very important benefit of a 401(okay) plan is which you could possibly make investments a bigger amount of your earnings into this account than you presumably can put into an individual retirement account (IRA) or a Roth IRA, which we’ll uncover beneath. People inside the workforce beneath 50 years outdated would possibly contribute as a lot as $22,500 per 12 months to their 401(okay), whereas these over 50 would possibly put an additional $6,500 into their account yearly.

At minimal you have to contribute the amount that’s matched by your employer—it’s free money!

2. Explicit particular person Retirement Account (IRA)

In case your employer doesn’t provide a 401(okay) plan, an IRA is no doubt one of the tax surroundings pleasant funding accounts you presumably can choose. This type of account means that you may take a deduction in your contribution (as long as you meet positive earnings restrictions) and defer tax on the money you initially deposit.

Your IRA can keep shares and bonds. It’s a terrific match in case your tax charge is liable to be bigger whilst you fund the account than it will be whilst you make a withdrawal—which is whilst you’ll be taxed in your earlier contributions. It’s best to begin taking money out of your IRA whilst you attain age 73, nonetheless you may start as early as age 59 for many who like.

3. Roth IRA

A Roth IRA is an account that allows your investments to develop tax-free. In distinction to a regular IRA, you pay tax upfront whilst you spend cash on this type of account. You’ll discover the benefits of a Roth IRA later down the freeway whereas you have to withdraw your money, because you acquired’t pay tax on it in the mean time. That’s significantly helpful for many who’re within the subsequent tax bracket whilst you withdraw the funds than you have got been whilst you opened the account. For individuals who’re considering this type of account, keep in mind that Roth IRAs have quite a few earnings limits.

4. Effectively being Monetary financial savings Account (HSA)

You in all probability have a medical insurance coverage plan with a extreme deductible, you’re eligible to open an HSA. Folks can put as a lot as $3,850 into their HSA, whereas households can contribute as a lot as $7,750 for 2023. The catch proper right here is that the money needs to be used for medical payments or Medicare premiums. The precept benefit of an HSA is that any money you’re taking out is tax-free.

Skilled tip: Many people spend cash on their HSA, let the wealth inside the account develop until retirement, and use the money then to cowl medical payments and Medicare premiums (HSA accounts are normally not allowed to be used for medical insurance coverage premiums). You acquire a tax deduction up entrance and the money comes out tax-free, to be used for medical payments or Medicare premiums. These 50 and older can contribute an additional $1,000.

5. 529 Account

A 529 account is no doubt one of the tax-efficient investments obtainable for many who’re planning to keep away from losing up in your children’s education or swap wealth to future generations.

Similar to a Roth IRA, this type of account grows tax-free. However, a 529 account doesn’t carry an annual contribution limit, though it’s actually useful you adjust to the annual current tax limits. In distinction, in 2023 a Roth IRA solely means that you may put $6,500 into the account yearly (or $7,500 for many who’re over 50). For individuals who’re saving for college, you’ll have a much bigger window to increase your wealth than for many who’re saving for elementary or secondary college. 529 contributions are nonetheless owned by the Account Holder and could possibly be accessed if needed. In addition to, you presumably can change beneficiaries if one (or further) of your children choose to not go to high school, or acquire a scholarship.

Rebalance Your Investments in Tax-Favored Accounts

It’s good to determine on plenty of sorts of tax-efficient accounts to broaden your portfolio, usually usually referred to as tax-diversification, and as a best apply it would even be prudent to you to include utterly different types of investments in each account. This method is also called asset location. As an illustration, it’s a superb suggestion to keep up frequent bonds (which carry the subsequent price of curiosity) in your IRA to defer tax on these investments. Nonetheless, in Roth IRAs and taxable accounts, it’s a superb suggestion to spend cash on further shares, ETFs, mutual funds, and doubtless dividend-paying shares to grab as quite a bit tax-free progress as attainable.

Skilled Tip: In a taxable account, shoot for further progress on account of capital optimistic elements—when realized—are taxed at a lower charge than odd earnings.

Asset location has an affect on rebalancing. All through rebalancing, you’ll have to bear in mind and modify to the asset kinds in your portfolio. If, as an illustration, your portfolio is in a taxable account, there are tax implications each time you rebalance: You’ll set off capital optimistic elements whilst you promote and buy. Ponder which sorts of investments are fitted to which sorts of accounts—and which sorts of accounts title for positive rebalancing schedules.

Giving to charity is one different choice to diversify your portfolio and reduce the amount you owe in your tax return. As an illustration, for many who’re a enterprise proprietor and likewise you promote your group for $1 million then resolve to current $100,000 to charity, you presumably can take your complete charitable tax deduction inside the 12 months you promote the enterprise, nonetheless you don’t should determine on the place to donate the money until later. Using a donor-advised fund means that you may make investments the money and choose the charity in the end.

Get Advice On Rebalancing With Taxes In Ideas

Bay Degree Wealth advisors transcend searching for and selling mutual funds. We try to find alternate options that can provide help to get financial financial savings and spot bigger price out of your investments. We are going to advocate in all probability probably the most tax-efficient investments in your personal financial state of affairs, and advise you on probably the greatest time to rebalance and reevaluate.

For individuals who’re critical about learning further about rebalancing or tax-efficient investments, schedule a free session title with one among our educated advisors instantly.