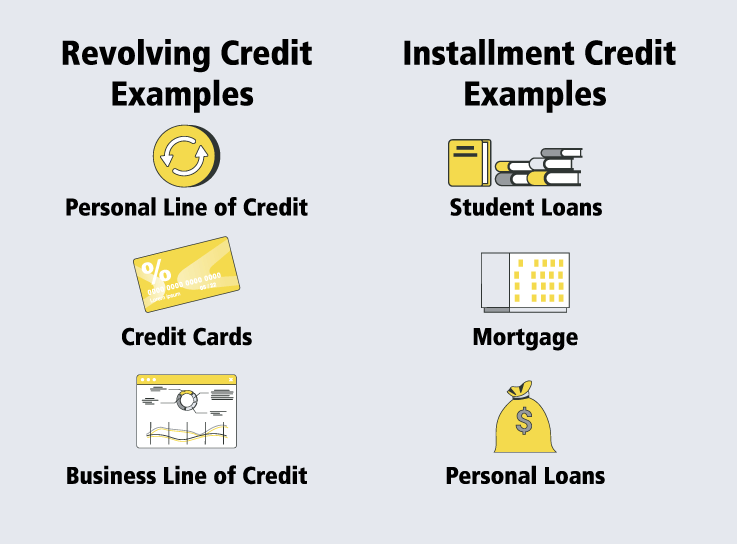

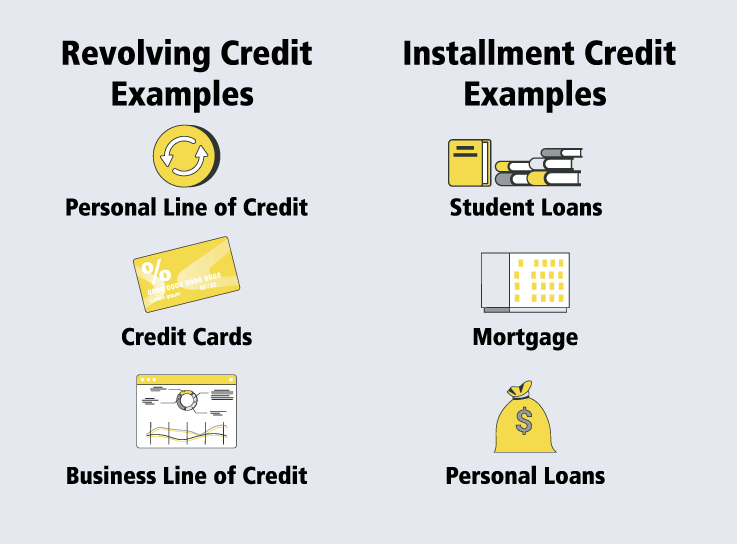

When you should have a line of credit score rating, there are two types of compensation building: revolving credit score rating and installment credit score rating. Every kinds of credit score rating are secured or unsecured. A secured installment mortgage is additional widespread.

Revolving Credit score rating: Your lender advances a set credit score rating prohibit that you just use abruptly or partly. You borrow the money, spend it, repay it, and spend it as soon as extra with revolving credit score rating.

Installment Credit score rating: Your lender advances your complete amount, and likewise you repay it with scheduled, periodic funds. You frequently cut back the principal, which results in paying off the distinctive amount.

What Is Revolving Credit score rating?

A line of credit score rating (LOC) or financial institution card is the most typical revolving credit score rating sort. When you make funds on this credit score rating line, your credit score rating prohibit doesn’t change. You presumably can borrow from it as rather a lot as you want when you don’t exceed the distinctive prohibit. There may be not a set price plan on account of you aren’t borrowing a lump sum. You presumably can borrow as a lot as your credit score rating prohibit. You’ll pay additional for this flexibility, elevated charges of curiosity, and presumably a lower borrowing amount. You’ll solely be charged for the amount you withdraw every month, not all of the credit score rating prohibit.

What Is Installment Credit score rating?

A automotive mortgage or mortgage is the most typical sort of this sort. Installment credit score rating is an account with a predetermined dimension, and shutting date, usually generally known as the mortgage time interval. the amount of your month-to-month funds and the way in which prolonged it’s important make these funds. If it’s important borrow extra cash, you could fill out one different software program.

Examples of Revolving Credit score rating and Installment Credit score rating

Advantages of Revolving Credit score rating

A revolving line of credit score rating has professionals and cons that have to be thought-about. That is the way in which it stacks up in opposition to installment credit score rating.

Versatile Borrowing

You get the utmost amount obtainable everytime you need it. Even when you occur to don’t want it correct now, you could have a piece of ideas. There is no such thing as a should bear a chronic approval course of when you occur to need extra cash. You utilize what you need on the time.

Covers Financial Powerful Spots

Even when in case you’ve an incredible credit score rating ranking, your cash transfer shall be uneven. Suppose you’re a salesman who sells cars and solely makes money from a handful of product sales a 12 months. A line of credit score rating will help you preserve current in your financial obligations via the months when your cash transfer is low.

You moreover might make most of your money over the previous fiscal quarter when you occur to private a seasonal enterprise. Your revolving credit score rating line will make it easier to hire wished employees, determining that you just’re going to satisfy the added costs later.

Secure Financing Chance

In case you desire a lower charge of curiosity, you might presumably apply for a secured line of credit score rating risk. It is best to make the most of types of collateral to protected your revolving credit score rating. Listed under are some examples:

- Precise property

- Gear

- Autos

- Stock portfolio

- Totally different priceless belongings

Compensation Flexibility

You should have the flexibleness to find out how and when your credit score rating line is repaid. Citing the occasion of the seasonal enterprise, after your busy season, you should have a great deal of cash available. You presumably can postpone compensation until your cash transfer helps it.

Disadvantages of Revolving Line of Credit score rating

Bigger Curiosity Costs

Because of revolving traces of credit score rating are versatile, lenders bear in mind them to carry additional menace. Because of this, you could most likely encounter elevated charges of curiosity than installment credit score rating. In case you’re in search of to make a giant purchase, bear in mind an installment mortgage as an alternative.

Temptation

Individuals overspend as soon as they’ve revolving credit score rating. Check out these financial institution card debt stats. There’s moreover an inclination to pay the minimal amount every month on account of it’s so small, spending a considerable amount on curiosity over time.

Lower Credit score rating Limits

As talked about above, revolving credit score rating is taken under consideration elevated menace important lenders to approve you for lower credit score rating limits. In case you need substantial financing, this line of credit score rating risk isn’t for you.

Stunning Adjustable Phrases

The phrases of use for revolving traces of credit score rating, collectively along with your charge of curiosity, can change with little uncover. You’ll not have to easily settle for any new phrases, nonetheless any new phrases legally bind you when you occur to proceed to utilize that credit score rating. Sadly, your solely option to not accept these new phrases is to pay your full stability and cancel that credit score rating line.

Advantages of Installment Credit score rating

Installment credit score rating has professionals and cons that it’s important bear in mind. That is the way in which it stacks up in opposition to a revolving line of credit score rating.

Predictable Funds

Month-to-month funds set on the same amount current predictability in your funds. As compared with revolving credit score rating, Installment credit score rating has a set time interval, charge of curiosity, and often, the similar month-to-month price.

Larger Mortgage limits

Because of lenders bear in mind any such credit score rating a lot much less harmful, you’ll entry elevated mortgage limits than with revolving credit score rating when you occur to can meet the requirements. In truth, it doesn’t counsel that you just is not going to be succesful to use for a smaller mortgage amount. You’ll get a mortgage for a few thousand {{dollars}} if that’s all you need.

Lower Borrowing Costs

By means of charges of curiosity, installment credit score rating shall be cheap. Lenders present lower charges of curiosity which may worth a lot much less over time. Some people use installment credit score rating to repay their revolving credit score rating when the speed of curiosity is lower.

Make Huge Purchases

Certainly one of many widespread choices of installment credit score rating is its versatility. As quickly as accepted, it’s best to use it to pay for a big purchase, comparable to a automotive. You might also use it to purchase a home and pay later in small portions for 15 to 30 years.

Disadvantages of Installment Credit score rating

Highly effective to Qualify

Because of the lower charges of curiosity, lenders have additional stringent requirements with the intention to qualify. They’ll bear in mind your income, credit score rating historic previous, and completely different glorious debt. Most revolving credit score rating traces are often additional lenient of their lending practices, notably for higher-risk debtors.

Prepayment Penalties

Some lending agreements gained’t make it easier to repay your credit score rating line early, so it’s important to study the efficient print. You’ll be charged a substantial fee for paying higher than the required amount each month or settle the debt solely.

Double Dipping

As talked about sooner than, it’s best to use installment credit score rating to repay your revolving credit score rating when you occur to find a lower charge of curiosity. Nonetheless, it’s necessary to decide to not use your revolving credit score rating. Working up new balances and the month-to-month funds required by your installment credit score rating will put additional stress in your funds.

Locked Phrases

Because of the phrases of your installment credit score rating are determined sooner than you shut, you’ll be unable to renegotiate. The price schedule, charge of curiosity, and phrases are set in stone. In case your financial situation modifications or your credit score rating improves, you’ll must refinance to get a higher charge of curiosity.

How Can You Assemble Credit score rating With Installment and Revolving Credit score rating?

The way you make the most of traces of credit score rating can truly injury your credit score rating ranking if it’s not used appropriately, nonetheless it could be good in your ranking when you occur to deal with every your credit score rating mix and your credit score rating utilization. Adjust to the next tricks to improve and assemble your credit score rating fast.

Don’t spend it abruptly: The best way you deal with your credit score rating stability is an efficient portion of your credit score rating ranking. Your credit score rating utilization ratio, how rather a lot you owe compared along with your credit score rating stability, is 30% of your FICO ranking. Protect your ratio beneath one-third of your prohibit, and your credit score rating will improve.

Pay funds on time: Make all your month-to-month funds on time on account of your price historic previous is the biggest take into account your credit score rating ranking. In case you miss any funds, your ranking will cut back significantly.

Use a number of kinds of credit score rating: Lenders actually really feel additional assured when you occur to current them that you could be deal with utterly differing types of credit score rating. Having every installment and revolving credit score rating will revenue your credit score rating ranking.

Don’t open too many accounts instantly: Having utterly completely different credit score rating types is a revenue, nonetheless you do not want to open all of them instantly. Be careful to not open too many accounts inside a few months or maybe a 12 months. Top-of-the-line approach is to assemble credit score rating steadily over time.

Proceed using your credit score rating: Your ranking will enhance when you occur to make use of credit score rating over an extended interval.

Make Educated Decisions About Your Credit score rating

Determining the excellence between revolving and installment credit score rating means that you would be able to make increased financial picks. Many borrowing selections will be discovered, whether or not or not your function is to save lots of money on curiosity, get by means of strong events, assemble your credit score rating, or repay your debt. Nonetheless, sooner than you apply for any credit score rating, be conscious the way in which it’ll affect you. Doing so will make it easier to deal with your funds and set you up for achievement.