Many lenders provide on-line loans with month-to-month funds. These lenders perform on-line and can even have bodily areas. There are pretty various on-line loans which have quick features and willpower processes. You would even get funds deposited in your checking account the an identical day you apply. Here’s what it’s greatest to find out about how these loans work, the benefits, and the alternatives obtainable.

APPLY NOW

Strategies to Get On-line Loans with Month-to-month Funds

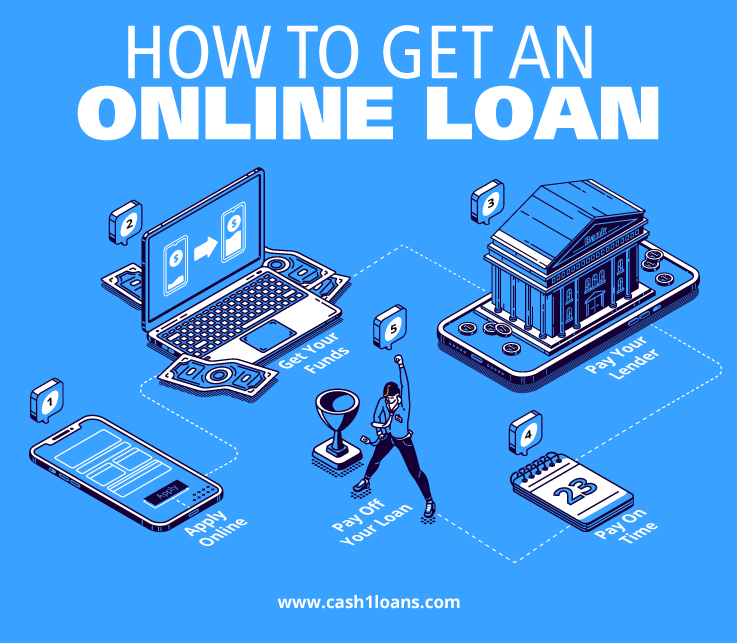

Whereas on-line lender processes might fluctuate, listed beneath are the most typical steps you probably can rely on to take when you apply:

- Everytime you apply for a mortgage on-line, the lender will request non-public and financial data by the use of a web-based software program. Your determine, contact data, date of begin, checking account, employment standing, and income are usually required.

- If accredited, you might get hold of your funds by the use of a monetary establishment change. The strategy would possibly take various enterprise days or the an identical day you utilized.

- While you get the mortgage, you might ought to pay it once more with curiosity. The funds will probably be due as quickly as a month.

- Counting on the phrases and circumstances of your mortgage, the lender will report optimistic data to credit score rating bureaus in case you make on-time funds. While you pay late or fail to repay the mortgage, the lender will report harmful info to the credit score rating bureaus.

- While you completely repay the mortgage, the account will probably be closed.

Sorts of On-line Loans With Month-to-month Funds

There are quite a few decisions for month-to-month on-line loans, along with, nevertheless not restricted to:

Installment loans

Most frequently, installment loans provide cheap charges of curiosity and don’t have any prepayment penalties. With an installment mortgage, you borrow a set amount of money and repay it over time with mounted month-to-month funds over various months or years.

Traces of credit score rating

While you’re in quest of one factor further versatile, a line of credit score rating would possibly provide the outcomes you need. After approval, you withdraw as little or as rather a lot as you need as a lot as your set credit score rating prohibit. You solely pay curiosity on the amount that you just simply borrow.

Title loans

If in case you’ve gotten a clear automobile title, you probably can change it for cash with a title mortgage. You keep driving your automotive as you repay the mortgage. They’re secured loans using your automotive title as collateral.

Auto loans

Everytime you purchase a automotive, you might usually need an auto mortgage. You’re going to get them by the use of dealerships, banks, or credit score rating unions. Most of these loans are paid month-to-month and have phrases from 12 to 96 months. Your newly purchased automobile acts as collateral in opposition to that mortgage. A lender has the approved correct to repossess your automotive in case you fail to satisfy the compensation requirements. As with each mortgage, study the phrases and circumstances sooner than signing the last word paperwork.

Mortgages

Mortgages are secured installment loans using borrowed money to buy a residential property. The phrases on mortgages fluctuate, going as a lot as 30 years. Because of they’re secured, your new home is used as collateral to make sure your mortgage. So, in case you fail to make funds, you probably can lose your individual residence.

What to Ask Your self Sooner than Making use of for an On-line Mortgage

While you’re fascinated about making use of for a mortgage on-line, there are some questions it’s greatest to ask your self sooner than you even start.

Why do I would like this mortgage?

The first question to ask your self is in case you desire a mortgage. Using the extra money to buy one factor you want and don’t want shouldn’t be a sound financial willpower. Moreover, ponder the amount you need and solely borrow what you probably can afford.

What’s my credit score rating score?

Many lenders take a look at components furthermore your credit score rating score to judge your talent to repay the mortgage. Nonetheless, counting on the lender you choose, your credit score rating score would possibly play a component. Your score would possibly moreover determine your mortgage amount. Each technique, realizing the place you stand regarding your credit score rating is essential.

Do I’ve the required documentation ready?

While you apply for a web-based mortgage, you might need to produce specific data. Requirements might fluctuate between lenders, nevertheless most will need some sort of reliable identification, proof of income, and proof of residency. Having the whole thing you need would possibly velocity up the equipment course of and get you the funds sooner.

APPLY NOW

Execs & Cons of On-line Loans with Month-to-month Funds

Sooner than making use of for a mortgage, ponder these benefits and drawbacks.

Execs

Consolation

You’ll be capable of apply in your mortgage on-line from home instead of going to the monetary establishment and speaking with a mortgage officer. The strategy is relatively simple, and whether it is advisable to, it will probably prevent the updates and return to the web software program later.

Fast turnaround time

On-line loans usually have a fast turnaround time in case you need quick funds. As quickly because the lender approves your software program, you probably can get hold of your funds on the an identical day or inside 24 hours.

In all probability low-interest costs and costs

On-line loans might have low-interest costs or no origination costs. Nonetheless, your costs normally rely in your basic financial profile and creditworthiness. In case your financial profile and credit score rating score aren’t the strongest, ponder a lender that permits cosigners or joint debtors.

On the spot payment quotes

Most on-line lenders provide the selection of pre-approval when you enter some essential data. You will note in case you prequalify for a mortgage. You’re going to get an considered the phrases and costs by ending the equipment. These corporations perform a clean credit score rating confirm all through pre-approval, so your credit score rating score won’t be affected.

Cons

Security concerns

Submitting your non-public data on-line could possibly be harmful in case you don’t work with a great lender. While you actually really feel assured borrowing from a web-based lending agency, solely use its official website online and browse its security protection. Suppose you do get hold of an unsolicited identify asking in your non-public data. In that case, it nearly positively is a rip-off and by no means a person affiliated with the lender.

Lack of loyalty reductions

Banks might provide price of curiosity reductions or rewards purposes to their shoppers. On-line lenders normally don’t provide reductions. Some, nonetheless, provide a lower price of curiosity in your mortgage in case you enroll in an auto-pay program.

No face-to-face buyer assist

With a web-based mortgage agency, you’ll probably have the power to speak to a guide over the cellphone, chat, or e mail. Nonetheless suppose you take pleasure in doing just a few points on-line. You would choose a monetary establishment, credit score rating union, or on-line lender with bodily areas.

Strategies to Look at On-line Loans With Month-to-month Funds

Evaluating lenders could possibly be overwhelming. As you evaluation, it’s greatest to carry these questions in ideas to determine on the proper on-line mortgage.

What’s the annual share payment (APR)?

Look at to see in case you possibly can prequalify for the mortgage to know your approval odds and acquire an estimated APR, mortgage amount, and month-to-month price. Then, you probably can look at totally different prequalified affords sooner than you apply.

How briskly is the funding?

While you require money fast, look at lenders based mostly totally on their funding time. You’ll uncover that some might take various days to course of your mortgage, whereas others provide next-day and even same-day funding.

What’s the mortgage amount?

Know each lender’s most and minimal mortgage portions, nevertheless don’t forget that how rather a lot you probably can borrow relies upon your creditworthiness. Solely borrow what you need and would possibly afford to repay. Lenders usually have on-line price calculators so that you probably can determine your month-to-month costs at completely totally different mortgage portions.

What’s the compensation interval?

The mortgage time interval varies primarily based in your creditworthiness, lender, and mortgage variety. Choose a lender with the shortest compensation phrases you probably can afford. You’ll repay the mortgage sooner and decrease your bills on the curiosity that doesn’t accrue.

What’s the reputation of the lender?

Look at evaluations and rankings on-line, and ask household and pals regarding the lenders. It’s going to help in case you obtained ideas about costs and buyer assist.

Does the mortgage have any specific choices?

Some on-line loans might have versatile price dates. Uncover out in case you possibly can add a cosigner, repay the stability early, or refinance for a lower APR later.

APPLY NOW

Conclusion

On-line lending is new as compared with standard banking. Nonetheless, the consolation of borrowing money inside the comfort of your individual house is gaining reputation. Making an knowledgeable willpower in regards to the right on-line mortgage for you is essential. Following the above concepts will allow you to pick a safe on-line lending agency, so that you’ll actually really feel assured with borrowing from a web-based lender.