Regardless of how fastidiously you plan your funds, sudden events in life might make your full financial planning go awry. Since chances are high you’ll need money anytime and wherever, you’re going to get authorised for a set sum of cash and withdraw it when you need it with a line of credit score rating mortgage.

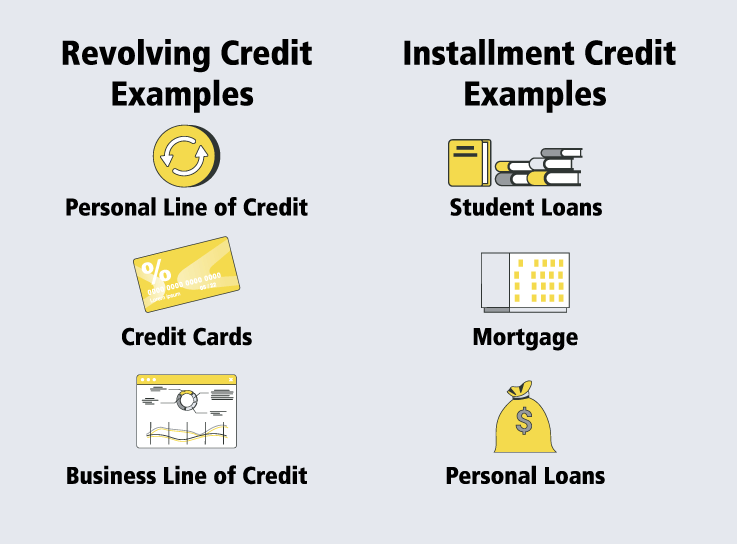

In distinction to an installment mortgage, you presumably can borrow a line of credit score rating at any time inside probably the most credit score rating prohibit and repay the mortgage that may help you borrow as soon as extra when emergencies come your methodology. This trend, you presumably can avoid borrowing larger than you need, saving the curiosity which you’d have incurred had you pulled out your full line of credit score rating mortgage.

Now, one can discover every secured and unsecured kinds of a line of credit score rating. With an unsecured line of credit score rating, you may be ready for any sudden expense with out the hazard of dropping your asset or property. Whereas a secured line of credit score rating moreover comes with its private set of benefits, we’re proper right here to let each little factor that it’s essential to discover out about an unsecured personal line of credit score rating to make your financial life additional manageable.

What’s an Unsecured Line of Credit score rating?

After we talk about an unsecured line of credit score rating, the easiest occasion that entails our ideas is financial institution playing cards which aren’t assured by any asset. In straightforward phrases, an unsecured line of credit score rating is a flexible financing chance that doesn’t require collateral security and means you can withdraw money various situations when needed inside your authorised prohibit. This means you’ll not should fill out a model new software program every time that it’s essential to borrow funds out of your unsecured line of credit score rating steadiness. By making minimal funds or paying off your full wonderful financial institution card balances on the end of each month, you presumably can restore your credit score rating prohibit that may help you make as many withdrawals as you need.

You’ll be questioning if an unsecured line of credit score rating doesn’t require any collateral to be authorised, then what do lenders check when you apply for this mortgage. Usually, lenders approve your line of credit score rating mortgage and provide a credit score rating prohibit based in your potential to repay. Some lenders check your credit score rating ranking, and some present an unsecured personal line of credit score rating even with a poor credit score rating historic previous. Whenever you get authorised, you presumably can have the benefit of quick entry to funds on an ongoing basis.

What are the Professionals and Cons of Unsecured Strains of Credit score rating?

There are quite a few advantages and drawbacks to choosing an unsecured line of credit score rating. It’s also possible to make your dedication of constructing use of for our personal line of credit score rating by fastidiously weighing the below execs and cons:

Professionals

- You needn’t private or pledge any property as collateral to protected the mortgage.

- That’s considered a quick and helpful answer to fulfill fluctuating cash needs.

- An unsecured line of credit score rating comes with versatile price selections and fairly priced charges of curiosity.

- These loans normally haven’t bought a time interval prohibit or end date and fall beneath an open-ended credit score rating class.

Cons

- It may be biggest in the event you occur to had good credit score rating to qualify for an unsecured line of credit score rating.

- They supply comparatively lower borrowing limits which cannot work biggest to pay for very important, one-time payments.

- Such credit score rating selections are riskier for lenders due to the absence of collateral, and as a result of this truth, the charges of curiosity are normally just a bit larger.

When Should I Choose an Unsecured Line of Credit score rating?

Although you must make the most of the funds you borrow using an unsecured personal line of credit score rating for any goal, you’ll not be able to use it for payments exceeding the credit score rating prohibit. For instance, you must make the most of this form of credit score rating line to finance your individual house repairs or renovation nevertheless not for purchasing your property. You presumably will pay for the sudden expense immediately with a non-public line of credit score rating and unfold the payment over various months by scheduling your funds.

In distinction to an installment mortgage, you presumably can apply for a line of credit score rating as quickly as and withdraw cash various situations as you need it. This perform makes them easiest for financial emergencies while you don’t have time to complete your full mortgage software program course of. So clearly, you presumably can choose an unsecured line of credit score rating counting on the goal of borrowing and the amount of funds you require.

All in all, you presumably can flip using an unsecured line of credit score rating into an excellent lending chance if when exactly they work biggest.