It could be easy to get overwhelmed by the varied sorts of credit score rating selections.

When researching, you come all through many alternative phrases. One which you’ll come all through is the time interval revolving credit score rating. This may doubtless lead you to ask, What’s revolving credit score rating? What types of borrowing fall beneath this class? And what advantages and disadvantages does this type of debt provide the widespread shopper? Realizing this information will make it simpler to borrow responsibly, defend your credit score rating score, and can even forestall 1000’s of {{dollars}} down the road.

On this text, we’ll break it down so you may also make further educated financial selections.

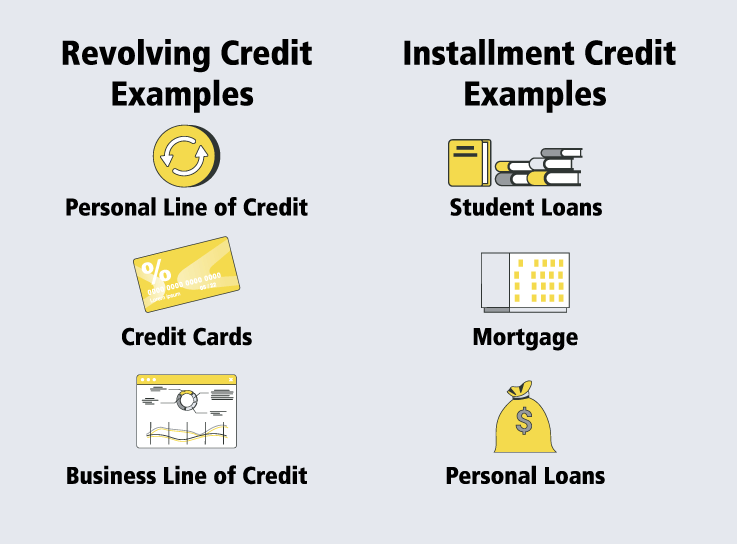

Revolving Credit score rating Examples

At its root, revolving credit score rating signifies that debtors are given money that’s repaid after which borrowed as soon as extra. Versus a one-time mortgage, you might be ready to borrow in opposition to your credit score rating line after you’ve obtained paid once more what you owe.

This type of borrowing is ongoing or revolving, which suggests you’ll be capable of proceed to borrow in opposition to your line of credit score rating as you see match. In some cases, you may even get accredited for a much bigger credit score rating amount. There are numerous sorts of credit score rating traces. Beneath are widespread examples of revolving credit score rating that can enable you to understand each kind you might get or apply for.

Credit score rating Enjoying playing cards

Given the definition, you may want put it collectively already that financial institution playing cards are an occasion of revolving credit score rating.

Financial institution playing cards are generally issued with a credit score rating most (i.e., $5,000) and a set fee of curiosity. This means debtors can put no more than the utmost on their account and will pay once more what they owe at that cost. When you’ve got poor credit score rating or haven’t obtained a credit score rating historic previous the least bit, charges of curiosity might be between 20 and 30 p.c. The standard is commonly between 15 and 17 p.c.

HELOCs

A home equity line of credit score rating (HELOC) is a type of revolving credit score rating the place the borrower locations their home down as collateral.

The amount borrowed comes from the equity in your own home, which is the excellence between how lots you owe in your mortgage and the best way a variety of it you’ve obtained paid once more.

If the mortgage is not going to be repaid inside the predetermined time period, the lender reserves the becoming to advertise your non-public house or arrange new phrases which can energy you to take out further debt in your non-public house.

Retailer Credit score rating Enjoying playing cards

Many outlet and retail outlets provide their in-house credit score rating selections for patrons.

Retailers like Kohl’s, Walmart, and totally different retailers generally provide prospects incentives in change for signing up. Usually, seeing must you’re accredited for a retailer financial institution card (with out signing up) can forestall.

Like a financial institution card, this amount should be paid off each month, or it accrues curiosity prices. Each retailer’s phrases are utterly totally different, so understanding what you might be signing up for is important.

Monetary establishment Accounts With Overdraft Security

Have you ever ever ever swiped your debit card for a purchase order order that value better than how lots was in your account?

If that’s the case, there’s a chance that overdraft security kicked in. This perform is obtainable at many banks and covers the excellence between how lots is left in your account and the best way lots it’s important to cowl the fee made.

Whereas that’s technically a line of credit score rating extended to you, it may happen in your checking or monetary financial savings account or using a debit card. Take a look at alongside along with your monetary establishment to know their requirements for using overdraft security. Usually, you don’t even must pay a cost must you promptly reimburse the monetary establishment.

Gasoline Station Enjoying playing cards

Like retailer financial institution playing cards, some gasoline stations provide revolving traces of credit score rating. They’ll solely be used at one explicit chain (typically) and be put in path of gasoline or in-store purchases.

These revenue people who drive hundreds for work or should replenish. As a purchaser, you generally are given cashback rewards or save on fill-up by swiping the cardboard.

Personal Traces of Credit score rating

A non-public line of credit score rating is further like a financial institution card than a personal mortgage.

With a personal mortgage, you borrow a set amount and pay it once more. As quickly as accomplished, the settlement is over. On a personal line of credit score rating, you’ll be capable of proceed to make revolving prices to your account and pay curiosity solely on what you owe.

Enterprise Traces of Credit score rating

A enterprise line of credit score rating is analogous as outlined above—merely to your agency’s desires.

Some entrepreneurs and enterprise householders take out a line of credit score rating when growing or pivoting their enterprise. The highway of credit score rating affords them the pliability to make purchases and pay it once more as they go.

Margin Funding Accounts

There are even widespread types of revolving credit score rating inside the brokerage world. The popular known as a margin funding account.

Proper right here, debtors pay a portion of a stock worth, and the supplier lends them the excellence. As a result of the borrower, you then pay curiosity on the mortgage. If the stock makes money in any other case you earn curiosity, this helps offset the related charge.

Distinction Between Revolving Credit score rating and Installment Loans

Every might be widespread (and helpful) selections inside the face of a financial catastrophe. Nonetheless understanding the excellence between installment loans and revolving credit score rating is important.

Briefly, revolving credit score rating is a further versatile type of borrowing. As outlined earlier, the borrower pays curiosity solely on what they borrow. As a result of it’s paid once more over time, the borrower can choose to take further in the event that they want. They could even be succesful to protected further funding in the event that they’re answerable for borrowing.

An installment mortgage is a set amount of money paid once more over a selected timeframe. Your vehicle mortgage, for example, is an installment mortgage. You’ll have agreed to pay it once more at $300 month-to-month for 4 years. As quickly as that’s accomplished, it’s paid off, and that line of credit score rating no longer exists.

The excellence between revolving credit score rating and installment loans is important because of it appears in any other case in your credit score rating score. Racking up a wide range of debt in your revolving credit score rating can negatively affect your score. Normally, debtors should intention to owe 30 p.c of their credit score rating limit or a lot much less.

Use Revolving Credit score rating to Your Profit

Being a accountable borrower is the vital factor to benefiting out of your revolving credit score rating selections. We outline a couple of of the problems you’ll be capable of reap the advantages of beneath.

Deal with Your Cash Motion

Suppose you may have an irregular earnings or ought to pay quite a few month-to-month payments. In that case, a revolving line of credit score rating can help. Instead of regularly worrying about how lots is in your account, you’ll be capable of borrow in opposition to your line of credit score rating or financial institution card after which pay all of it off on the end of the month.

Plan Ahead if You Desire a Mortgage

Must you’ll need a mortgage or line of credit score rating, it’s also a beautiful time to pay down the cash owed you owe.

Sustaining a extreme steadiness might disqualify you from certain mortgage agreements or lead to a greater fee of curiosity provide.

Administration Your Spending

People get in hassle with their credit score rating account after they let spending get out of hand.

Nonetheless ought to you possibly can maintain it beneath administration, that’s superior! Usually, you’ll be capable of borrow money and by no means even pay curiosity must you get your steadiness once more to zero shortly ample.

There are totally different perks to controlling your spending with revolving credit score rating.

As an illustration, many rewards enjoying playing cards provide 1 or 2 p.c cash once more on purchases. You get half whilst you buy and the alternative half whilst you pay it off.

In keeping with the IRS, that money is not going to be solely free—it’s also not counted as taxable earnings. Some rewards packages provide miles or lodge stays in its place of cash. Look into what matches your life-style!

Pay Further Than the Minimal

You on a regular basis want compound curiosity in your facet with revolving credit score rating traces. The simplest means to do this is by paying better than your minimums each month.

As an illustration, must you took out a $5,000 line of credit score rating at a 14 p.c fee of curiosity and solely paid the minimal of $200 on it each month, it would take 2.5 years to repay.

In that time, you’d end up paying $946 in curiosity! Must you paid $800 a month, you’ll be accomplished in 7 months with solely $223 in curiosity.

The power of compound curiosity shouldn’t be taken calmly. There’s a function Einstein known as it the eighth marvel of the world.

Disadvantages of Revolving Credit score rating

Like a number of financial decision, there are potential drawbacks to using revolving credit score rating.

Listed below are some downsides it’s worthwhile to ponder when deciding if it’s the becoming alternative for you.

Failing to Pay Once more What You Borrow Each Month

Revolving credit score rating undoubtedly has its advantages. It’s versatile and helpful in a number of circumstances. Nonetheless not paying your cash owed once more can stink. Some companies, significantly financial institution playing cards, set ruthless phrases for people who borrow and don’t pay once more.

The standard penalty cost is barely under 28 p.c APR in your financial institution card. That may be a steep amount that will very effectively be 2 or 3 cases your widespread fee of curiosity.

Easy to Make Impulse Purchases

Usually it’s onerous to don’t forget that your line of credit score rating constitutes precise money. For some, it’s less complicated to rack up prices than see their monetary financial savings account get low or their cash disappear.

Revolving traces of credit score rating aren’t good ought to you might be more likely to impulse spend or retailer emotionally. You could shortly put your self in a position that’s onerous to return again out of, accruing an entire lot in curiosity each month.

Missing Funds Can Hurt Your Credit score rating Ranking

Missing funds can harm your future self, too. Other than owing rather more money than sooner than, collectors can report your delinquent accounts to the three credit score rating bureaus.

A low credit standing makes it extra sturdy so as to borrow money ultimately. Most delinquency cases for shopper credit score rating hold in your credit score rating for as a lot as seven years.

Getting a mortgage, taking out one different non-public mortgage, and even getting a model new retailer financial institution card might very effectively be tougher ultimately. They often’ll moreover likely value you bigger charges of curiosity due to your poor charge historic previous.

How Can Revolving Accounts Have an effect on Your Credit score rating?

Your credit score rating score consists of some elements:

- Price historic previous

- Accounts owed

- Measurement of credit score rating historic previous

- Credit score rating mix (ratio of customer cash owed vs. enterprise debt, and so forth.)

It isn’t an equal weight, each. Price historic previous makes up an important part of your score. So must you miss funds steadily, borrowing money might significantly have an effect on your credit score rating score.

It’s, nonetheless, potential to boost your credit score rating score. In some cases, you’ll be capable of dispute claims despatched to the bureaus and have them taken off your account.

Nonetheless for most people, it requires merely buckling up and developing their credit score rating once more up from scratch. This may take years, and even with a flawless report of 5 years of reimbursement, these outdated unpaid cash owed can nonetheless come once more to haunt you.

Revolving Credit score rating is a Useful Financial Instrument

Hopefully, that helps clarify the question, What’s revolving credit score rating? From financial institution playing cards to HELOCs to gasoline station rewards enjoying playing cards, revolving credit score rating is a flexible kind of debt. You could make the minimal charge on it as you see match and borrow further ultimately.

Have you ever ever been denied a line of credit score rating? You’ll be capable of apply on-line with CASH 1 must you reside in Idaho, Kansas, Missouri, Louisiana, or Utah.